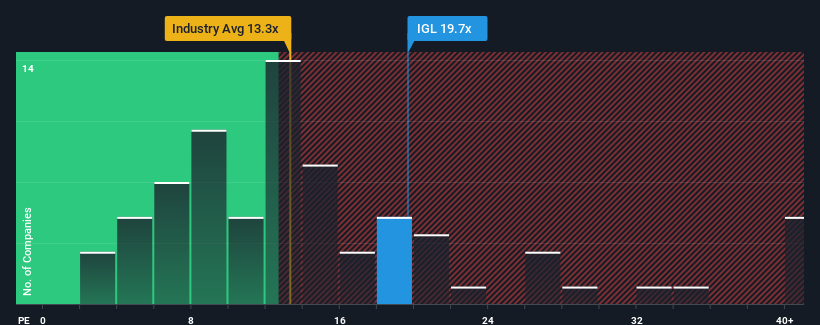

When almost half of the companies in India have a price-to-earnings (P/E) ratio of over 33x, you can consider Indraprastha Gas Limited (NSE:IGL) with its P/E ratio of 19.7x appears to be an attractive investment. However, the P/E ratio may be low for a reason and further research is required to determine if it is justified.

The recent past has not been favorable for Indraprastha Gas, as earnings have grown more slowly than most other companies. The P/E ratio is probably low because investors believe this lackluster earnings performance will not improve. If you still like the company, you hope earnings do not deteriorate and that you can buy some shares while it is out of demand.

Check out our latest analysis for Indraprastha Gas

Do you want to know how analysts see the future of Indraprastha Gas compared to the industry? In this case, our free Report is a good starting point.

Is there growth for Indraprastha Gas?

A P/E ratio as low as Indraprastha Gas’s would only be truly comfortable if the company’s growth lags behind the market.

If we look at the earnings growth over the last year, the company has seen a fantastic increase of 16%. The strong recent performance means that it has also been able to achieve a total earnings increase of 37% over the last three years. So, first of all, we can say that the company has done an excellent job of growing its earnings during this time.

As for the outlook, the company is expected to deliver a growth of 3.2% per year over the next three years, as estimated by analysts covering the company. With the market expected to deliver a growth of 20% per year, the company must expect a weaker result.

With this information, we can see why Indraprastha Gas is trading at a lower P/E than the market. It seems that most investors expect limited future growth and are only willing to pay a lower amount for the stock.

The last word

We usually caution against reading too much into the price-earnings ratio when making investment decisions, even though it can say a lot about what other market participants think about the company.

We found that Indraprastha Gas maintains its low P/E because the growth forecast is lower than the broader market, as expected. For now, shareholders accept the low P/E because they acknowledge that future earnings are unlikely to bring pleasant surprises. Under these circumstances, it is difficult to imagine the share price rising much in the near future.

You should also inform yourself about 1 warning sign we discovered with Indraprastha gas.

If you are interested in P/E ratiosyou might want to see this free Collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.