The cautious market reaction suggests SK Gas Co., Ltd. (KRX:018670) The latest results contained no surprises. Our analysis suggests that investors should pay attention to other underlying weaknesses in the numbers in addition to weak earnings numbers.

Check out our latest analysis for SK Gas

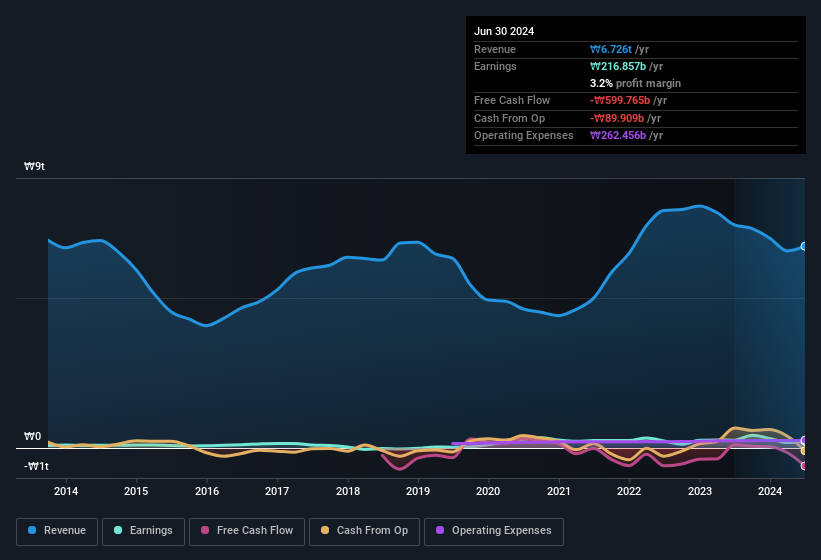

A closer look at SK Gas’ earnings

In high finance, the most important metric that measures how well a company converts reported earnings into free cash flow (FCF) is the Delimitation ratio (from cash flow). Simply put, this metric subtracts FCF from net income and divides that number by the company’s average funds from operations during that period. You can think of the from cash flow metric as a “non-FCF profit metric.”

This means that a negative accrual ratio is a good thing because it shows that the company is generating more free cash flow than its earnings would suggest. While it is not a problem to have a positive accrual ratio that indicates some level of non-cash profits, a high accrual ratio is arguably a bad thing because it indicates that there is no cash flow to match accounting profits. To quote a 2014 paper by Lewellen and Resutek, “Companies with higher accruals tend to be less profitable in the future.”

For the year to June 2024, SK Gas had a provisioning ratio of 0.20. Unfortunately, this means that its free cash flow fell significantly short of its reported earnings. In fact, over the last twelve months, it had Negative free cash flow, with an outflow of ₩600 billion despite the aforementioned profit of ₩216.9 billion. It’s worth noting that SK Gas generated positive free cash flow of ₩111 billion a year ago, so at least they have managed that in the past. However, there’s more to the story. We can see that unusual items have affected statutory profit and hence the accrual ratio.

You may be wondering what analysts are predicting in terms of future profitability. Fortunately, you can click here to see an interactive chart depicting future profitability based on their estimates.

The impact of unusual items on profit

Given its provision ratio, it’s not too surprising that SK Gas’s earnings were boosted by ₩13 billion worth of unusual items over the last twelve months. We can’t deny that higher earnings generally make us optimistic, but we would have preferred the profit to be sustainable. We’ve run the numbers for most listed companies globally, and it’s very common for unusual items to be one-off in nature. And that’s exactly what the accounting terminology implies. Unless SK Gas repeats this contribution, all else being equal, we’d expect its earnings to decline in the current year.

Our assessment of SK Gas’s earnings development

SK Gas had a weak accrual ratio, but its profit was boosted by unusual items. For the reasons outlined above, we believe a cursory glance at SK Gas’s statutory profits could make them look better than they actually are at an underlying level. Remember, when analyzing a stock, it’s important to note the risks associated with it. Every company has risks, and we’ve found 3 warning signals for SK Gas (2 of which we don’t like so much!) that you should know about.

In this article, we’ve looked at a number of factors that can affect the usefulness of earnings numbers, and we’ve tread carefully. But there’s always more to discover if you’re able to focus on the small details. For example, many people consider a high return on equity to indicate a favorable business situation, while others like to “follow the money” and look for stocks that insiders are buying. You might want to check this out. free Collection of companies with high return on equity or this list of stocks with high insider ownership.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.