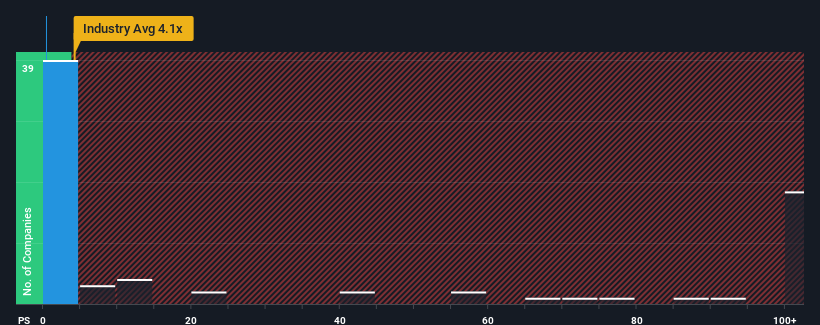

With a price-to-sales ratio (or “P/S”) of 0.4x Australis Oil & Gas Limited (ASX:ATS) may be sending very bullish signals right now, as almost half of all oil and gas companies in Australia have a P/S ratio of over 4.1x, and even P/S ratios of over 81x are not uncommon. However, it is not wise to simply take the P/S at face value, as there may be an explanation as to why it is so low.

Check out our latest analysis for Australis Oil & Gas

How has Australis Oil & Gas performed recently?

For example, consider that Australis Oil & Gas’s financial performance has been poor recently as revenue has been declining. Many may expect the disappointing revenue performance to continue or accelerate, which has depressed the price-to-earnings ratio. If you like the company, you’d hope that doesn’t happen so you can potentially buy some shares while it’s out of favor.

Do you want a complete overview of the company’s profit, sales and cash flow? Then free The report on Australis Oil & Gas will help you shed light on the company’s historical performance.

Is Australis Oil & Gas forecast to grow revenue?

There is a fundamental assumption that a company must lag far behind the industry average for P/S ratios like Australis Oil & Gas’s to be considered reasonable.

First, if we look back, the company’s revenue growth last year was not exactly exciting as it posted a disappointing 17% decline. The last three years do not look good either as the company posted a total revenue decline of 15%. Accordingly, shareholders were sobered about medium-term revenue growth rates.

If you compare this medium-term sales development with the one-year forecast for the entire industry, which assumes growth of 49%, this is not a good prospect.

With this in mind, we understand why Australis Oil & Gas’s P/S ratio is lower than most of its industry peers. Still, there is no guarantee that the P/S ratio has already bottomed out as revenues are declining. There is a possibility that the P/S ratio could fall to even lower levels if the company fails to improve its revenue growth.

Conclusion on Australis Oil & Gas’s profit and loss account course

It’s not a good idea to use the price-to-sales ratio alone to decide whether to sell your stock, but it can be a useful guide to the company’s future prospects.

It is no surprise that Australis Oil & Gas maintains its low P/S ratio due to declining revenues over the medium term. At this point, investors believe the potential for improving revenues is not large enough to justify a higher P/S ratio. Unless recent medium-term conditions improve, they will continue to form a barrier to the share price around these levels.

You should always think about the risks. A typical example: We have 2 warning signs for Australis Oil & Gas You should be aware.

If you uncertain about the strength of Australis Oil & Gas’s businesswhy not explore our interactive stock list with solid business fundamentals for some other companies you may have missed.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.