New estimates based on industry shipping data and IRS statistics show that consumers are making more efficient choices when selecting natural gas heaters.

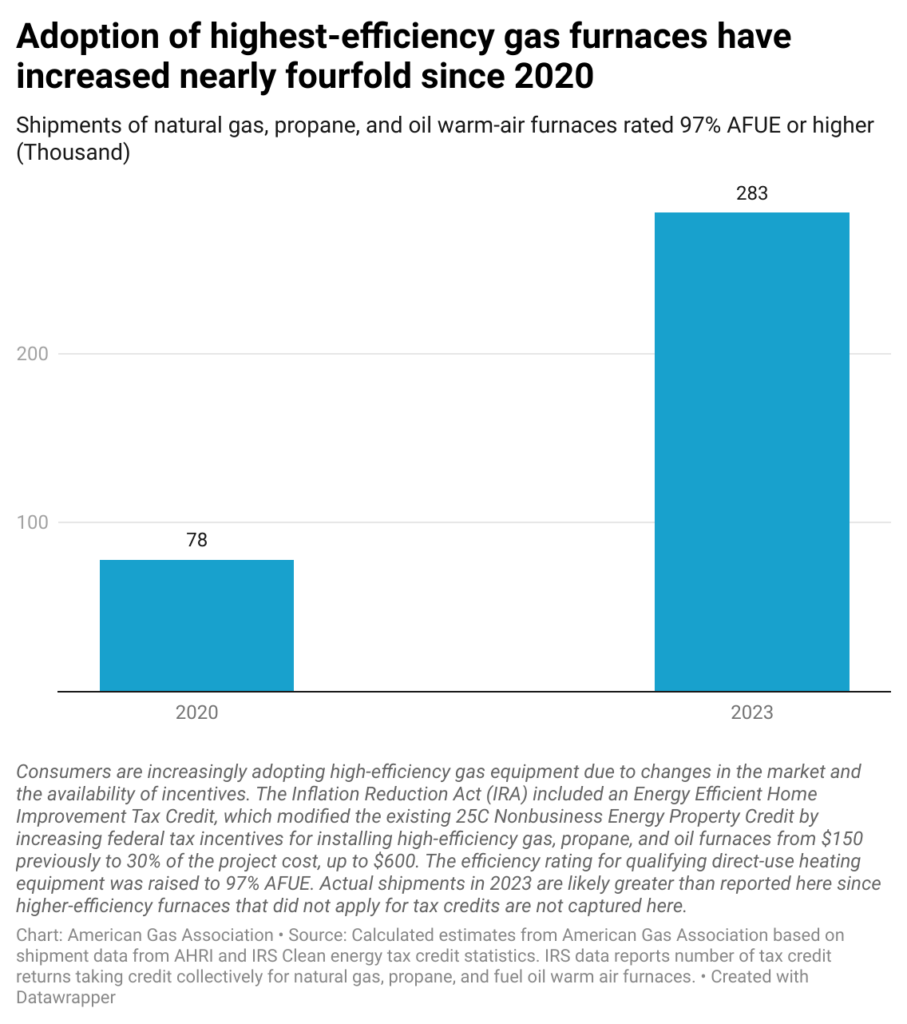

Data from the implementation of tax credits under the Inflation Reduction Act of 2022 show that the number of high-efficiency (97%+ AFUE) natural gas furnaces installed by consumers has increased significantly since 2020. Consumers continue to choose natural gas appliances to heat their homes and are increasingly installing the most efficient models.

background

The Inflation Reduction Act (IRA) created a tax credit for energy efficient home improvements, which expanded the existing 25C non-commercial energy property tax credit. This expansion increased federal tax incentives for a wide range of energy efficient home improvements, including high-efficiency gas, propane, and oil burners. Under the 25C provision, incentives were increased to 30% of project costs and a maximum of $600. To qualify, burners must have an annual fuel utilization rate (AFUE) of 97% or greater.

The Air-Conditioning, Heating & Refrigeration Institute (AHRI) tracks home appliance shipments and reported that 3.3 million furnaces were shipped in 2020, including those for existing homes and new construction. Of those, only 2.8% had a 97%+ AFUE rating. This market share was calculated using government shipment data from a Department of Energy Regulatory Agency analysis of consumer furnaces. Aside from the 520,000 gas and propane systems installed in new homes, about 78,000 of the furnaces shipped in 2020 had a 97%+ AFUE rating.

AHRI delivery data, when combined with Internal Revenue Service (IRS) tax credit statistics, can provide insight into current market trends. The IRS reported that 283,390 taxpayers claimed the $600 IRA tax benefit for gas and oil furnaces (and boilers) on their 2023 tax returns. This benefit is only available for existing homes. In 2023, 3,012,135 natural gas, propane and oil forced air furnaces were delivered, according to AHRI, of which 492,000 were installed in new homes. Based on this, it can be estimated that if 84% of the remaining furnaces were delivered for existing homes, at least 11% of the remaining furnaces had an AFUE rating of 97%+. Actual shipments in 2023 are likely higher because this analysis does not include shipments of furnaces with AFUE of 97%+ for which no tax credits were claimed.

More information

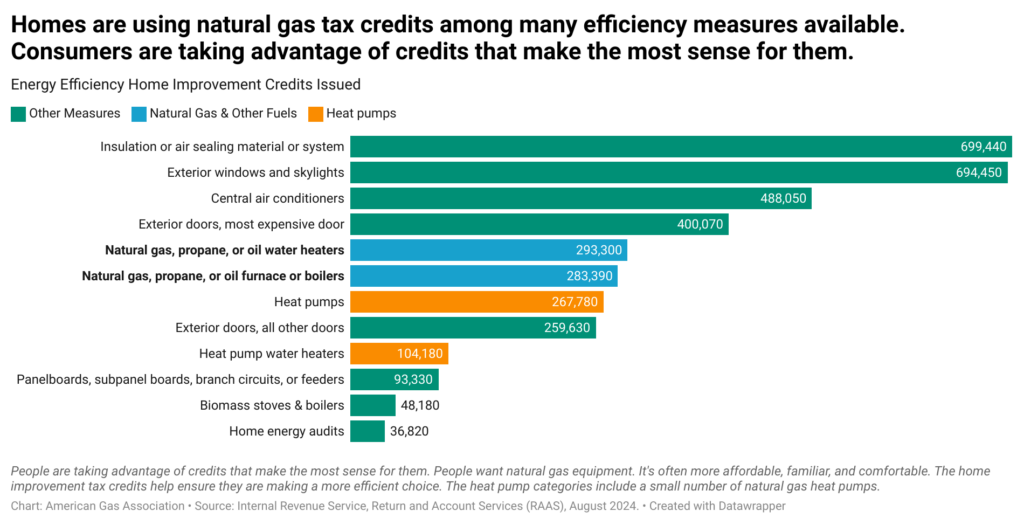

The Internal Revenue Service provides statistics on the use of tax credits made available under the Inflation Reduction Act of 2022. The data includes the number of tax returns claiming the Energy Efficient Home Improvements Tax Credit and the Residential Clean Energy Tax Credits available under the IRA. The IRS data shows that 576,690 households claimed the credits for water heaters, furnaces and boilers using natural gas, propane and oil.

To qualify for the $600 credit:

- Gas furnaces must achieve an annual fuel efficiency (AFUE) of over 97%.

- Gas hot water tanks must have a Uniform Energy Factor (UEF) greater than 0.81 for tanks less than 55 gallons and greater than 0.86 for tanks 55 gallons or more.

- Gas-fired instantaneous water heaters must have a UEF of over 0.95.

For electric and gas heat pumps, 30% of the project costs can be reimbursed up to USD 2,000 per year.

Source: AGA calculations, Internal Revenue Service, Air Conditioning, Heating, and Refrigeration Institute, Department of Energy

AGA Contact: Brendan O’Brien | [email protected] | 202-824-7220

Observe: By issuing and making this publication available, AGA does not undertake to perform professional or other services for or on behalf of any person or entity. Nor does AGA undertake to fulfill any obligation that any person or entity may have to any other person. Anyone using this document should rely on his or her own independent judgment or, where appropriate, seek the advice of a competent professional to determine whether reasonable care can be taken in any particular circumstance. The information in this publication is for general information purposes and represents an unaudited compilation of statistical information which may include coding or processing errors. AGA makes no express or implied warranties or representations as to the accuracy of the information in the publication or its suitability for any particular purpose or situation. This publication should not be construed as containing advice, guidance or recommendations to take or refrain from taking any action or decision of any kind, including but not limited to investing or buying or selling any securities, stocks or other assets of any kind. If you take any such action or decision, you do so entirely at your own risk. Information on the subjects discussed in this publication may also be obtained from other sources which the user may wish to consult for additional views or information not contained in this publication.

Copyright © 2024 American Gas Association. All rights reserved.