As Europe shapes its energy future, two interrelated trends are transforming the gas market: a significant expansion of LNG capacity and the strategic exit from Russian gas. These trends are analyzed in detail in the Europe Gas & LNG Market Outlook 2024 and provide important insights into the continent’s evolving energy landscape.

LNG expansion: strengthening resilience and capacity

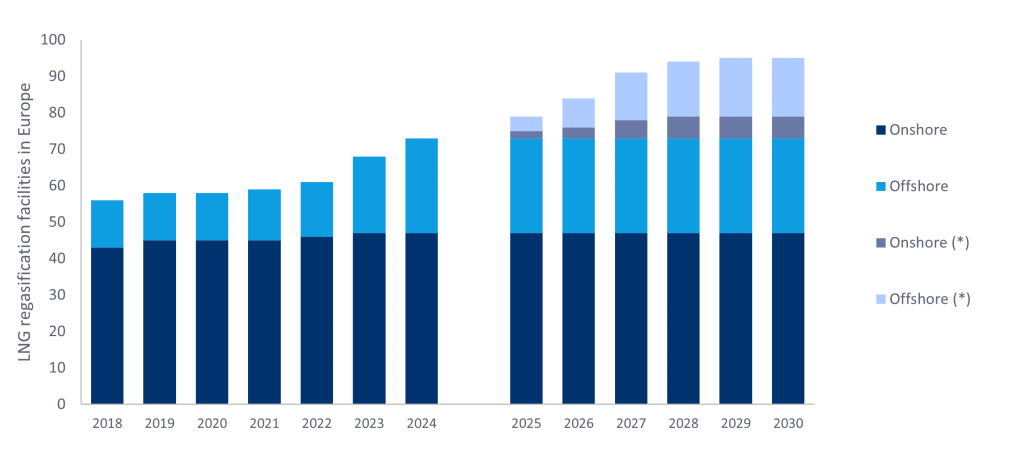

European countries are actively expanding their LNG regasification capacity, with growth forecast at 47.3% by 2030. This expansion underscores a strategic shift towards improving energy security and diversifying gas supply sources in response to geopolitical instability. The continent’s regasification capacity, which stood at 10,983 bcf in 2024, is expected to increase significantly, driven by significant projects in several countries.

Countries such as Germany, Spain and the UK are leading the way in this area and are expected to account for 52% of the continent’s total regasification capacity by 2030. The German Stade power plant, scheduled to come online in 2027, will be one of the most significant projects, with a capacity of 469.5 bcf and an INVESTMENT of over $1.2 billion. The Belgian Zeebrugge power plant will also be significantly expanded, reflecting a general trend towards significant investment in LNG infrastructure.

Following the invasion of Ukraine in 2022, there was a rapid development of new regasification plants, especially offshore

A key factor in this rapid expansion has been the use of floating storage regasification units (FSRUs). These units offer a flexible and faster alternative to traditional onshore plants and allow countries to rapidly increase their LNG import capacity. Countries such as Germany, the Netherlands and Greece are pioneers in the use of FSRUs, with numerous units planned or already in operation.

This strategic shift is further supported by long-term contracts with major LNG suppliers such as Qatar and the United States. These agreements ensure a steady flow of LNG to Europe, justify the significant investments in regasification infrastructure and strengthen the continent’s energy resilience.

Access the most comprehensive company profiles on the market, powered by GlobalData. Save hours of research. Gain a competitive advantage.

Company profile – free sample

Your download email will arrive shortly

We are confident in the unique quality of our company profiles, but we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by filling out the form below.

By GlobalData

Russian gas phase-out: a complex transition

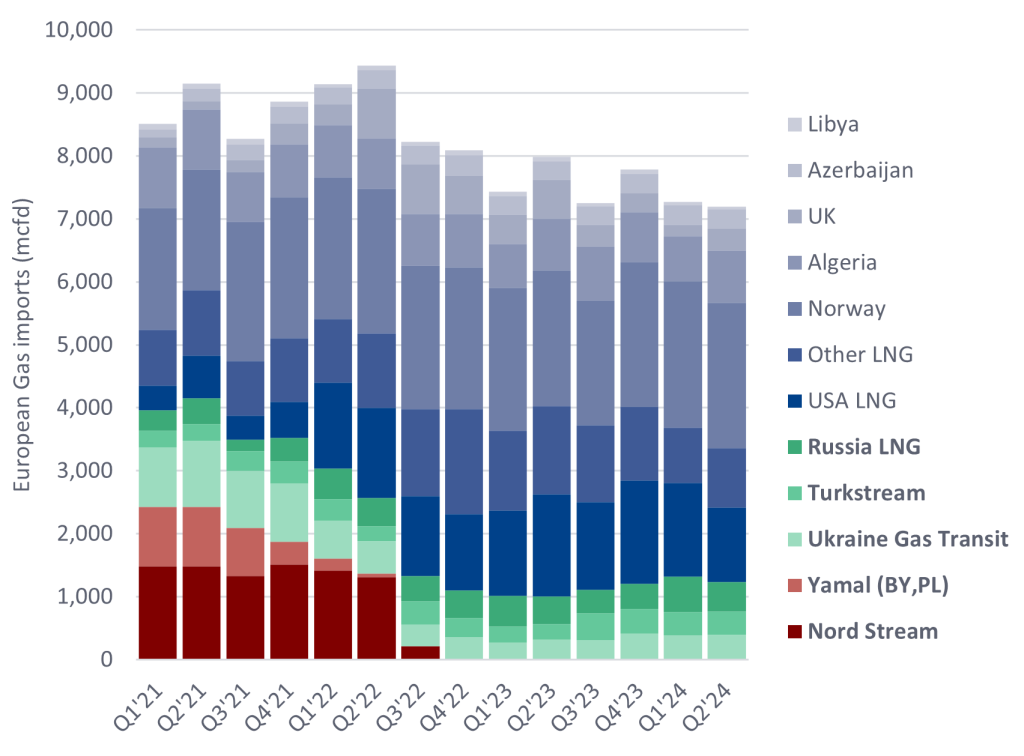

The phase-out of Russian gas supplies, a crucial part of Europe’s energy strategy, has been heavily influenced by geopolitical events and decisions by Russian partners. The Nord Stream pipelines have been out of service since the sabotage incidents in September 2022, effectively cutting off a key supply route. Meanwhile, gas supplies from Russia through the Yamal-Europe pipeline were suspended in April 2022, a decision by Gazprom. Thus, Europe’s reduction in Russian gas imports was arguably reactive rather than preventive, and driven by external action rather than a unified EU initiative.

Before the invasion of Ukraine, Russian gas accounted for a remarkable 46.5% of European gas imports in 2021. This share fell to an all-time low of 12.6% by the summer of 2023, but has since recovered slightly to 18% in the fall and winter months.

According to current development plans, production in Nigeria’s most important oil fields is expected to decline (2024)

Interestingly, while gas supplies from Russia via pipeline have declined significantly, LNG imports from Russia remain relatively stable, underscoring the complexity of a complete exit from Russian energy supplies. Moreover, the 7% increase in gas supplies via pipeline in the first half of 2024, although still 75% below 2021 levels, suggests continued, albeit lower, dependence on Russian gas via pipeline.

Efforts to diversify gas sources have also been hampered by infrastructure and development constraints on alternative supply routes, such as Azerbaijan and the Maghreb Pipeline.

In summary, the Europe Gas & LNG Market Outlook 2024 reveals a continent in transition, strategically expanding its LNG capacity while grappling with the complexities of phasing out Russian gas. These efforts are critical to improving energy security and stability in an increasingly volatile geopolitical landscape. The full report provides detailed analysis and comprehensive data and valuable insights into Europe’s dynamic gas market.