On August 22, 2024, Chad Whalen, Executive Vice President, Worldwide Sales at F5 Inc (NASDAQ:FFIV), sold 5,493 shares of the company. The transaction was documented in a recent SEC filing. After this sale, the insider now owns 21,738 shares of F5 Inc.

F5 Inc specializes in multi-cloud application services and security solutions, helping organizations seamlessly scale cloud, data center, telecommunications, and software-defined network deployments.

Over the past year, Chad Whalen has sold a total of 8,569 shares and has not purchased any shares of the company. This latest transaction is part of a broader trend seen at F5 Inc., where there were no insider purchases over the past year, but 35 insider sales.

F5 Inc.’s stock price was $198.88 on the day of the transaction. The company has a market capitalization of approximately $11.60 billion. F5 Inc.’s price-to-earnings ratio is 21.38, which is below both the industry median of 25.24 and the company’s historical median.

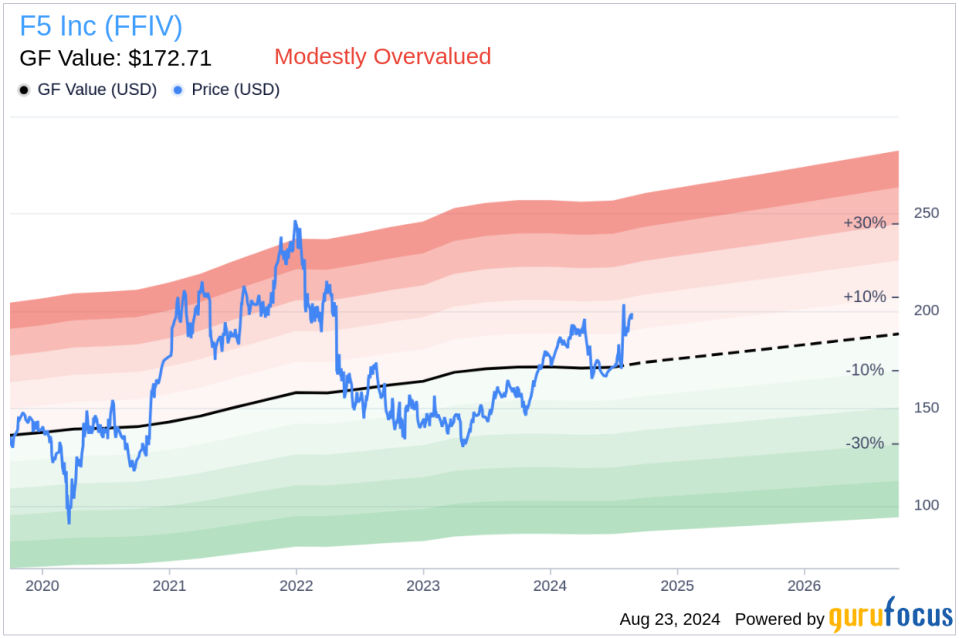

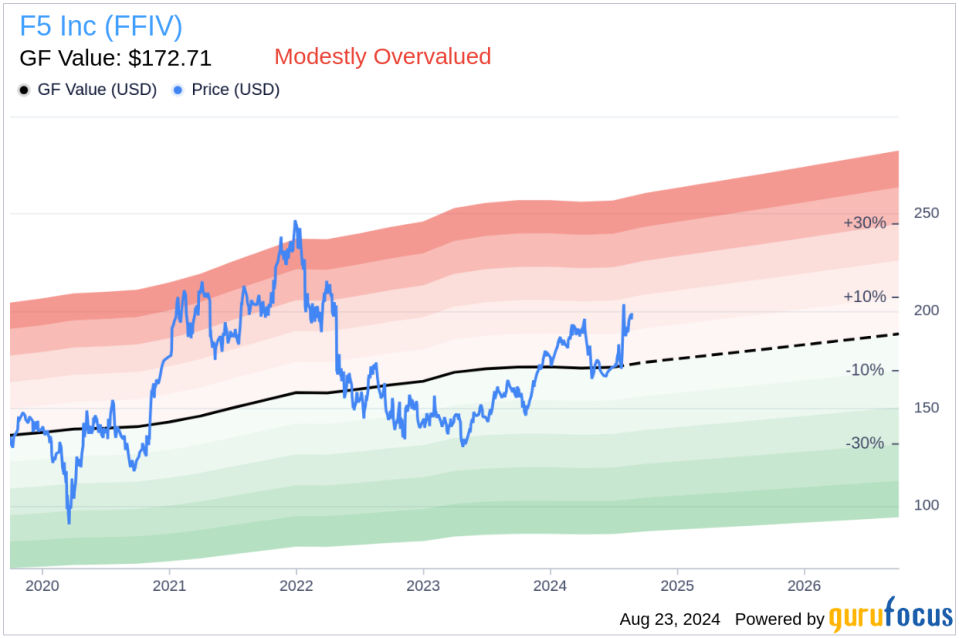

The stock is valued at $172.71 according to GF Value, which means that F5 Inc. is slightly overvalued with a current price of $198.88 and a price-to-value ratio of 1.15.

The GF value is calculated by taking into account historical trading multiples such as price-to-earnings ratio, price-to-sales ratio, price-to-book ratio and price-to-free cash flow, along with a GuruFocus adjustment factor based on past earnings and growth as well as Morningstar analysts’ views on future business performance.

This insider sale could be of interest to investors who track insider behavior and evaluate the stock’s current valuation metrics against historical performance and industry standards.

This article created by GuruFocus is intended to provide general insights and does not constitute tailored financial advice. Our commentary is based on historical data and analyst forecasts, uses an unbiased methodology and is not intended to serve as specific investment advice. It does not contain a recommendation to buy or sell any stock and does not take into account any individual investment objectives or financial circumstances. Our goal is to provide long-term, fundamental, data-driven analysis. Note that our analysis may not include the most recent, price-sensitive company announcements or qualitative information. GuruFocus does not hold a position in any stocks mentioned here.

This article first appeared on GuruFocus.