The external fund manager backed by Berkshire Hathaway’s Charlie Munger, Li Lu, makes no bones about it when he says: “The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.” So it seems that the smart money knows that debt – which is usually associated with bankruptcies – is a very important factor when assessing the risk of a company. We note that InfoVision Optoelectronics (Kunshan) Co., Ltd. (SHSE:688055) has debt on its balance sheet. But should shareholders be concerned about its use of debt?

Why is debt risky?

Debt helps a company until it struggles to pay it back with either fresh capital or free cash flow. If the company can’t meet its legal obligations to pay off debt, shareholders could end up empty-handed. More common (but still costly), however, is that a company must issue shares at bargain prices, permanently diluting shareholders’ ownership, just to shore up its balance sheet. The benefit of debt, of course, is that it often represents cheap capital, particularly when it replaces a company’s dilution with the ability to reinvest at a high rate of return. When we think about a company’s use of debt, we first consider cash and debt together.

Check out our latest analysis for InfoVision Optoelectronics (Kunshan)

How much debt does InfoVision Optoelectronics (Kunshan) have?

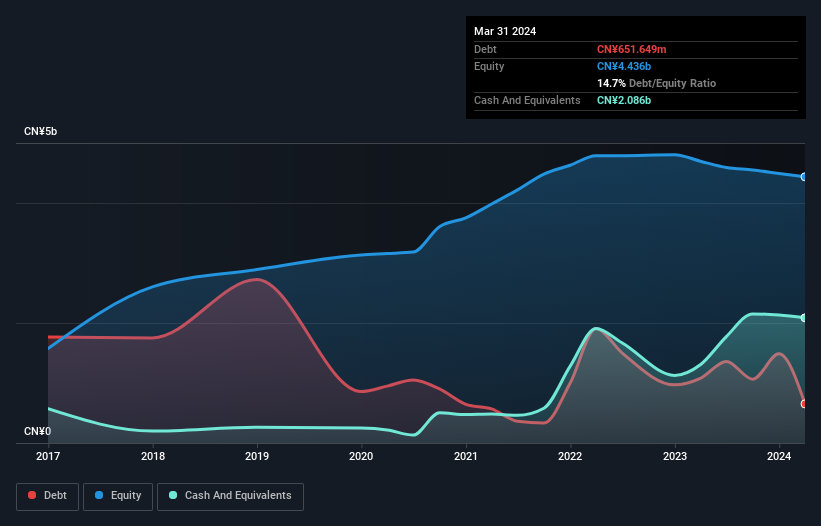

The image below, which you can click on for more details, shows that InfoVision Optoelectronics (Kunshan) had CN¥651.6 million in debt at the end of March 2024, a reduction of CN¥1.08 billion year-on-year. However, this is offset by CN¥2.09 billion in cash, resulting in net cash of CN¥1.43 billion.

How strong is the balance sheet of InfoVision Optoelectronics (Kunshan)?

Taking a closer look at the most recent balance sheet data, we can see that InfoVision Optoelectronics (Kunshan) had liabilities of CNY2.63 billion due within 12 months and liabilities of CNY172.7 million due beyond that. These liabilities had CNY2.09 billion in cash and CNY589.9 million in receivables due within 12 months. So liabilities total CNY131.0 million more than the combination of cash and short-term receivables.

Considering InfoVision Optoelectronics (Kunshan)’s size, its cash and total liabilities seem to be well balanced. While it’s hard to imagine the CN¥9.93b company struggling with cash, we still think it’s worth keeping an eye on the balance sheet. Despite its sizeable liabilities, InfoVision Optoelectronics (Kunshan) has net cash flow, so it’s fair to say the company doesn’t have a heavy debt load! Undoubtedly, the balance sheet is where we learn the most about debt. But you can’t look at debt in isolation, since InfoVision Optoelectronics (Kunshan) needs profits to service that debt. So when thinking about debt, it’s definitely worth looking at the earnings trend. Click here for an interactive snapshot.

InfoVision Optoelectronics (Kunshan) reported revenue of CN¥3.9 billion for the last 12 months, up 7.7%, although the company did not report earnings before interest and taxes. We usually like to see faster growth in unprofitable companies, but to each their own.

How risky is InfoVision Optoelectronics (Kunshan)?

Although InfoVision Optoelectronics (Kunshan) posted a loss before interest and tax (EBIT) over the last twelve months, the company generated positive free cash flow of CN¥466 million. So, taking that at face value and considering the net cash situation, we don’t think the stock is too risky in the short term. Until we see positive EBIT, we are a little cautious on the stock, not least because of the rather modest revenue growth. The balance sheet is clearly the area to focus on when analyzing debt. But ultimately, every company can contain risks that exist outside the balance sheet. Case in point: we found 1 warning sign for InfoVision Optoelectronics (Kunshan) You should be aware.

If, after all that, you’re more interested in a fast-growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.