Some say that volatility, not debt, is the best way to think about risk as an investor, but Warren Buffett once said, “Volatility is far from synonymous with risk.” So it seems that the smart money knows that debt – which is usually associated with bankruptcies – is a very important factor when assessing the risk of a company. We can see that Sportsman’s Warehouse Holdings, Inc. (NASDAQ: SPWH) does indeed use debt in its business. But should shareholders be concerned about its use of debt?

When is debt a problem?

Generally, debt only becomes a real problem when a company can’t easily pay it back, either by raising capital or through its own cash flow. In the worst-case scenario, a company can go bankrupt if it can’t pay its creditors. However, a more common (but still costly) case is when a company has to issue shares at bargain prices, permanently diluting shareholder ownership, just to shore up its balance sheet. However, the most common situation is when a company manages its debt reasonably well – and to its own advantage. The first step in looking at a company’s debt levels is to look at its cash and debt together.

Check out our latest analysis for Sportsman’s Warehouse Holdings

How much debt does Sportsman’s Warehouse Holdings have?

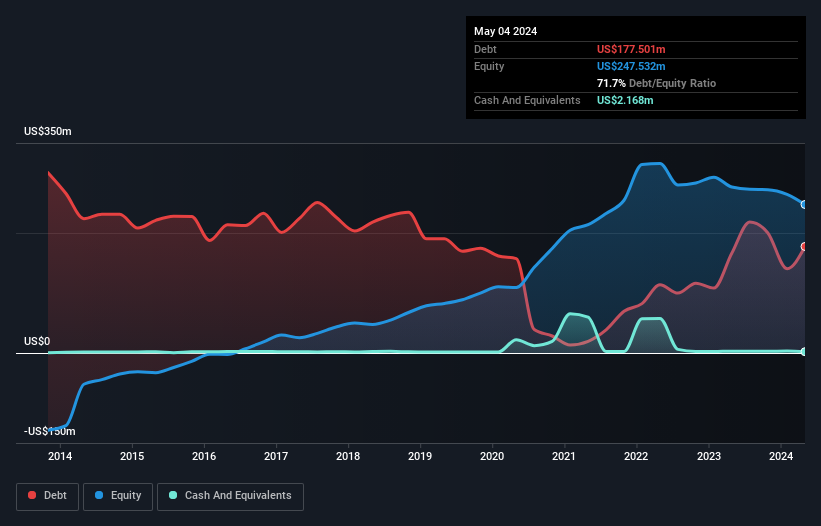

The image below, which you can click on for more details, shows that Sportsman’s Warehouse Holdings had $177.5 million in debt as of May 2024, up from $166.3 million a year earlier. Net debt is about the same because the company doesn’t have much cash.

A look at Sportsman’s Warehouse Holdings’ liabilities

According to the last reported balance sheet, Sportsman’s Warehouse Holdings had liabilities of US$368.0 million due within 12 months and liabilities of US$314.9 million due beyond 12 months. On the other hand, the company had cash of US$2.17 million and receivables of US$2.10 million due within a year. So, the company’s liabilities total US$678.6 million more than its cash and short-term receivables combined.

This deficit casts a shadow over the US$73.2 million company, like a behemoth towering over mere mortals. So we firmly believe shareholders should keep a close eye on it. Ultimately, Sportsman’s Warehouse Holdings would likely need to undertake a major recapitalization if its creditors were to demand repayment. When analyzing debt levels, the balance sheet is the obvious place to start. But it’s future earnings, more than anything, that will determine whether Sportsman’s Warehouse Holdings can maintain a healthy balance sheet going forward. So if you want to know what the professionals think, you might find this free report on analyst earnings forecasts interesting.

Last year, Sportsman’s Warehouse Holdings posted a loss before interest and taxes and saw its revenue actually shrink by 6.7% to $1.3 billion. We would like to see growth.

Reservation by the buyer

Importantly, Sportsman’s Warehouse Holdings posted a loss before interest and tax (EBIT) last year. In fact, it lost a sizeable $21 million at the EBIT level. Given that and its significant total liabilities, it’s hard to know what to say about the stock as we have a strong dislike towards it. As with any underdog, we’re sure it has a glossy presentation outlining its sky-high potential. But the fact is that it burned through $5.8 million in cash over the last twelve months and has very little liquid assets compared to its liabilities. So is this a high-risk stock? We think so, and we would avoid it. There’s no doubt that we learn the most about debt from the balance sheet. However, not all investment risk lies on the balance sheet – quite the opposite. We have identified 3 warning signs with Sportsman’s Warehouse Holdings, and understanding them should be part of your investment process.

Of course, if you’re one of those investors who prefers to buy stocks without the burden of debt, you should discover our exclusive list of net cash growth stocks today.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.