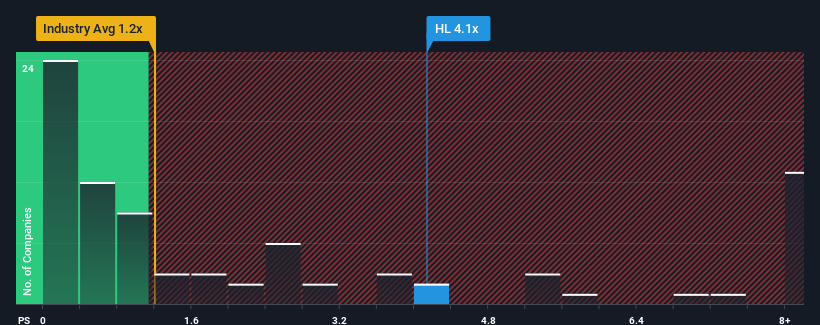

The Hecla Mining Company (NYSE:HL) price-to-sales ratio (or “P/S”) of 4.1x may seem like a poor investment opportunity considering that nearly half of the companies in the metals and mining industry in the United States have a P/S ratio below 1.2x. However, the P/S might be quite high for a reason and further research is needed to determine if it is justified.

Check out our latest analysis for Hecla Mining

How Hecla Mining has developed

Hecla Mining may be doing better as revenue growth has been slower than most companies recently. Perhaps the market is expecting future revenue trends to reverse, which has increased the price-to-earnings ratio. If not, existing shareholders may be very concerned about the profitability of the share price.

Would you like to know how analysts assess the future of Hecla Mining compared to the industry? In this case, our free Report is a good starting point.

What do the sales growth metrics tell us about the high P/S?

A P/S ratio as high as Hecla Mining’s would only be truly comfortable if the company’s growth is on track to significantly outpace the industry.

First, if we look back, we can see that the company managed to grow its revenue by a respectable 8.2% last year. However, this was not enough as overall revenue declined by an unpleasant 4.9% over the last three-year period. Therefore, it is fair to say that the revenue growth has been unwelcome for the company recently.

According to the six analysts who cover the company, revenue is expected to grow 15% next year. The rest of the industry is forecast to grow 19%, which is much more attractive.

With that in mind, it’s alarming that Hecla Mining’s P/S is higher than most other companies. It seems that many of the company’s investors are much more optimistic than analysts indicate and aren’t willing to dump their shares at any price. There’s a good chance that these shareholders are setting themselves up for future disappointment when the P/S falls to a level more in line with the growth prospects.

The last word

In our view, the price-to-sales ratio does not serve primarily as a valuation tool, but rather helps to assess current investor sentiment and future expectations.

It is surprising that Hecla Mining is trading at such a high price-to-earnings ratio, as its revenue forecasts look anything but promising. At the moment, we are not comfortable with the high price-to-earnings ratio, as its forecast future revenues are unlikely to sustain such positive sentiment for long. This puts shareholders’ investments at significant risk and potential investors risk paying an excessive premium.

It is always necessary to consider the ever-present specter of investment risk. We have found 2 warning signs with Hecla Miningand understanding these should be part of your investment process.

If this Risks make you rethink your opinion of Hecla Miningexplore our interactive list of high-quality stocks to get a sense of what else is out there.

Valuation is complex, but we are here to simplify it.

Find out if Hecla Mining could be undervalued or overvalued with our detailed analysis, with Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.