For the third year in a row, the U.S. is expected to set new records for housing construction, with developers planning to have completed an astonishing 518,108 rental units by the end of 2024, an astonishing 30% more than in 2022 and 9% more than in 2023, according to a new study from RentCafe.

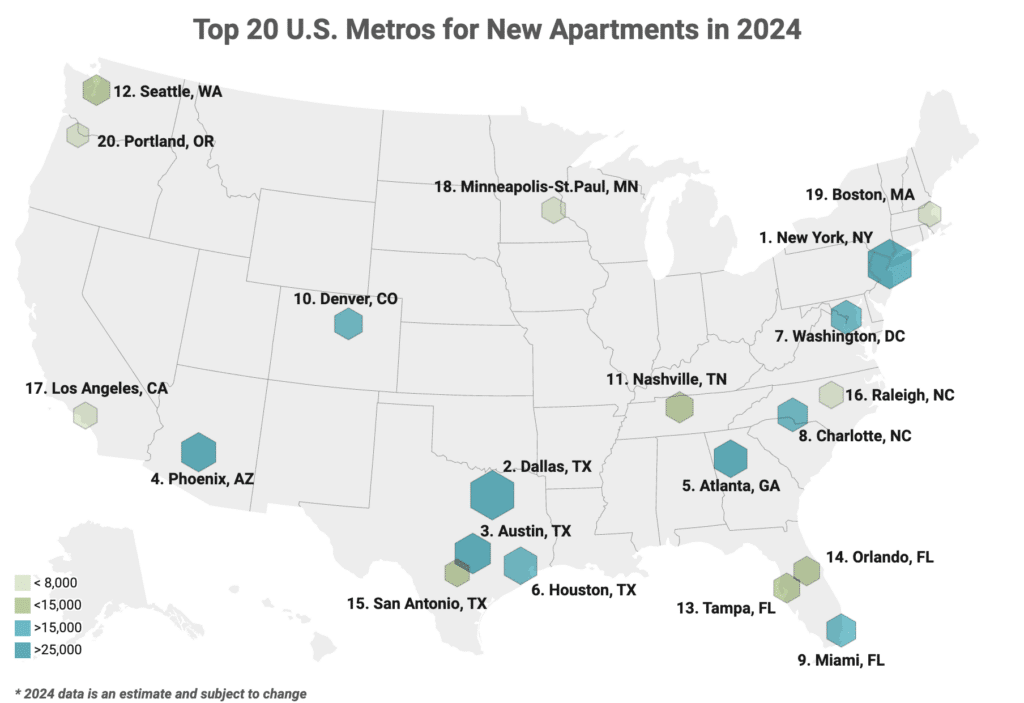

In addition, 2024 will be the first year in U.S. housing history that the total number of completed units will surpass 500,000 units. For the third year in a row, the New York metropolitan area leads the way, followed by the popular Texas metropolitan areas of Dallas and Austin. Notably, by the end of December, the combined Dallas and Austin metropolitan areas are expected to account for about 10% of all new housing built nationwide.

“The supply surge has resulted in new additions at 50-year levels in some metropolitan areas … but increased competition is slowing rent growth, especially in the booming Sun Belt markets,” said Doug Ressler, senior analyst and manager of business intelligence at Yardi Matrix.

In addition, demand for apartments remains strong despite falling rents in the Sun Belt.

Despite market uncertainties that prevent many new projects from starting, 2 million housing units are planned to open by 2028. In addition, 47% of the 369 metropolitan areas studied are expected to develop more strongly in the next five years than in the years between 2019 and 2023.

Because the number of renters has increased significantly over the past 50 years, demand for rental housing in the United States continues to exceed supply. This is true despite recent construction efforts following the housing boom of the early 1970s, when a comparable number of rental housing units came onto the market as baby boomers came of age.

Regional differences in housing development can be attributed to a number of variables, including demand, local laws, climate and economic conditions. Nevertheless, according to our assessment, the top 20 metro areas are home to about 60% of the new housing expected to come on the market in 2024. This suggests that current supply in the remaining areas is unlikely to increase significantly this year.

The majority of housing built in the last five years is upscale neighborhoods and primarily targets upper-middle and upper-class renters. Renters in smaller regions may still have few affordable options available, as new housing is concentrated in major U.S. metropolitan areas and the emphasis is on upscale neighborhoods.

Even if the number of apartments built reaches a record in 2024, the report says the multifamily market will be negatively impacted by rising loan prices, forcing many developers to change their plans for the coming years. As a result, they may focus on lower-risk initiatives or turn to industries with high demand and job growth.

“The overall impact on the number of developers could vary by region,” Ressler said. “In places like Texas, for example, demand for housing remains robust due to factors like corporate migration and high home prices. On the other hand, some markets are seeing a decline in housing starts due to the economic environment.”

Notably, some developers are seeing a shift in the market where property sellers are now more willing to negotiate. This, coupled with lower labor costs, is opening doors for long-term thinkers, especially in regions where there is currently oversupply. Over the next year and a half, the outlook for these markets should improve significantly.

In 2025 and beyond, the landscape of residential construction will play out a little differently. Ressler explained that most markets will not see how quickly declining housing starts translate into lower completion rates until the second half of 2025 and most likely not until 2026. “All in all, this significant decline in housing starts across all regions paves the way for a significantly different industry trajectory through 2026 and 2027.”

Developers expect to complete a record 518,108 apartments this year and will deliver 440,478 new units in 2025 – a 15% decline from 2024. The construction rate is expected to drop even further through 2027, when completions are expected to hit a 10-year low with 319,000 rental apartments opening nationwide. After that, a big spike is expected in 2028, when over 391,000 apartments are expected to come online, an increase of nearly 23% from the previous year.

New York Metro to open nearly 33,000 apartments in 2024

The New York metropolitan area is “well positioned” to expand on last year’s exceptional apartment construction. Specifically, 32,935 additional rental units are expected by the end of December 2024.

Nearly 30% (9,379 units) of the total number of new units in the New York metro will be in Brooklyn, followed by Manhattan at a distant second, where 2,979 new rental apartments will be built. In addition, 2,412 units are scheduled to be completed in Jersey City, NJ by local developers.

The ongoing housing crisis in the Northeast is the main driver of the New York metropolitan area’s housing boom. Boston, which debuted at No. 19 in our ranking and is scheduled to open 8,022 brand-new rental units in the region this year, is the only other Northeastern metropolis to make our top 20 for new housing completions in 2024.

The thriving life sciences sector in Greater Boston is largely responsible for the increase in new housing construction, as it increases demand for housing, according to RentCafe findings. For example, the cities of Cambridge and Boston combined are home to over 1,000 biotech companies, both large and small, making Greater Boston one of the leading biotech clusters in the U.S. Demand for housing has increased due to the region’s continued appeal to professionals, students, and their families.

The developers there plan to complete 32,932 housing units by 2024. It is noteworthy that the majority of the planned completions (5,267 housing units) of new housing are expected in Dallas itself. In Fort Worth and Frisco, 2,020 new apartments and 4,608 rental apartments are to be opened in the immediate vicinity.

Dallas continues to attract businesses and construction projects due to its steadily growing population (more than 150,000 new residents came to the metropolis between July 2022 and July 2023 alone), business-friendly atmosphere, affordability compared to other metropolises of similar size, and excellent infrastructure. Of course, corporate relocations increase wages and create jobs throughout the metroplex, driving economic growth and attracting housing-dependent immigrants.

Austin, Texas in particular, is set to see an incredible 12,157 new housing units built by year’s end, accounting for over 56% of all expected deliveries in the metro area. The reason is understandable: Fueled by a robust job market, prospects in the tech, healthcare and hospitality sectors, and the influx of major tech companies attracted by Texas’ income tax exemption, Austin is growing and changing. And even as housing costs rise, people are steadily moving from more expensive coastal cities to more remote work locations.

Phoenix ranks fourth, with 20,141 new homes planned across the metropolitan area by the end of 2024. The majority of these construction projects are taking place in Phoenix itself, and developers aim to complete 7,389 housing units, or over a third of all housing units in the region, by the end of the current development phase.

Finally, Atlanta completes the top 5, with 18,520 new homes expected by the end of the year. Here too, Atlanta is expected to lead construction activity in 2024, with 7,184 units scheduled to be completed there, nearly half of all planned new homes in the metropolitan area.

Click here to read the full report with additional data, charts and methodology information.