We recently published a list of Jim Cramer talks about these 10 stocks as the market recovers. With Shopify Inc (NYSE:SHOP) ranking fifth on the list, the company deserves a closer look.

Jim Cramer, on his recent show on CNBC, discussed the recent market rally, which was followed by a massive sell-off on Monday. He suggested that we could “worry” about interest rates, the job market, or mortgage rates, or we could simply buy the stocks of “great” companies and hold on to them.

“Stock prices have become so dependent on macroeconomics, carry trade and Fed talk that it’s impossible to give you a blanket answer, even though I’ve told you time and time again that the American economy is doing much better than one would expect at this stage of the cycle,” Cramer said.

Cramer again complained that people believed that a 25 basis point drop in interest rates could somehow “motivate” them to spend more, and because of this hope, they often bought “wrong” ETFs.

Cramer also said the Fed will not begin cutting rates until it sees consumers “rebelling” against higher prices and businesses being forced to scale back price increases to pre-COVID levels. Jim Cramer believes we now have an “empowered consumer who is willing to make choices and choose options that are cheaper and better.” He said that during the pandemic, given the increased liquidity, people were willing to accept higher prices, but not now.

For this article, we watched several recent shows by Jim Cramer and selected 10 stocks he talks about. Why do we care about the stocks hedge funds invest in? The reason is simple: Our research has shown that we can outperform the market by mimicking the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks each quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points. (Further details can be found here).

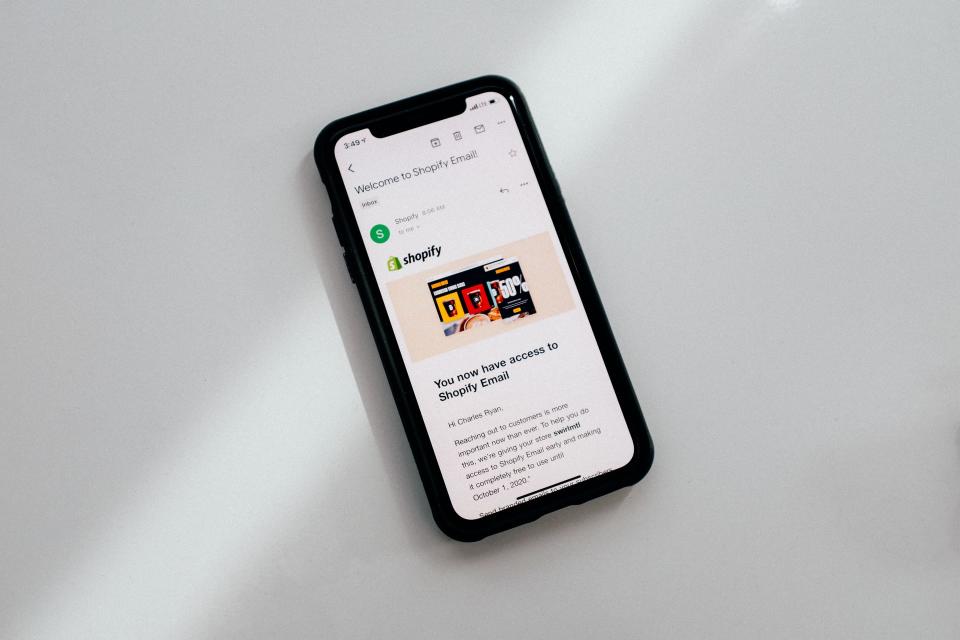

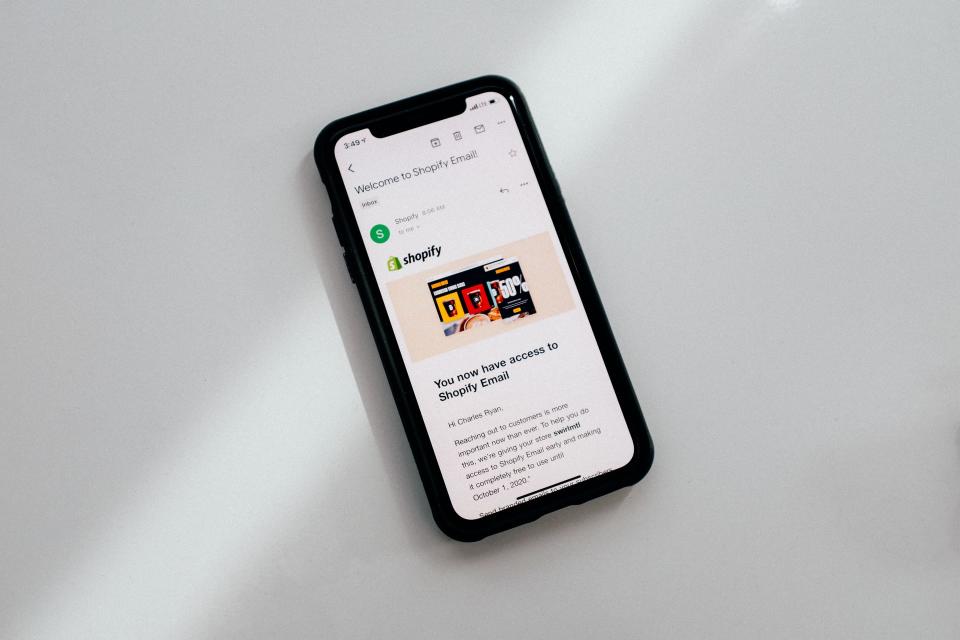

Photo by Charles Deluvio on Unsplash

Shopify Inc. (NYSE:SHOP)

Number of hedge fund investors: 65

Jim Cramer was asked about Shopify on a recent show. Here is his answer:

“I really, really like this stock. It’s fallen a lot and I think this is a really, really good position to be in.”

Cramer said Shopify had to spend a lot of money, which they didn’t want to, but “it’s really paying off.”

Shopify hit the jackpot with its impressive second-quarter results. Free cash flow increased a whopping 240% to $333 million during the period. The company reported 21% year-over-year revenue growth, driven by a 22% increase in gross merchandise volume (GMV) to $67.2 billion, although GMV growth slowed slightly from the previous quarter. The Subscription Solutions segment, which includes all subscriptions, saw revenue increase 27% to $563 million. This segment is benefiting from potential price increases that accelerated growth last year. Merchant Solutions, Shopify’s largest revenue generator, generated $1.48 billion, up 19% year-over-year.

Shopify expects third-quarter revenue growth in the low-to-mid 20% range, beating the consensus estimate of 21%. Although SHOP’s P/E ratio is high, at around 60, stock bulls believe the company’s EPS growth expectations of around 43% and Shopify’s rapid expansion in gross merchandise volume and free cash flow justify this valuation.

BofA added Shopify Inc (NYSE:SHOP) to its list of best stocks for the third quarter of 2024. Wall Street continues to shower Canadian e-commerce store platform Shopify Inc (NYSE:SHOP) with positive reviews and commentary. Goldman Sachs analyst Gabriela Borges upgraded the stock to Buy from Neutral and raised her price target on SHOP to $74. She said Shopify Inc (NYSE:SHOP)’s investments in marketing will “soon pay off” and drive revenue growth through 2025.

JPMorgan initiated coverage of the stock with an Overweight rating. JPMorgan analysts said Shopify Inc.’s (NYSE:SHOP) competitive advantages include product breadth, ease of use and scalability. These advantages will continue to drive Shopify’s “industry-leading” growth, according to the bank.

Poland Focus Growth Strategy stated the following about Shopify Inc. (NYSE:SHOP) in its Investor letter Q2 2024:

“In the second quarter, we bought new positions in Shopify Inc. (NYSE:SHOP). Shopify, a leading cloud-native commerce software platform, is a company we have been watching since 2018 and have long admired. Shopify’s business model combines 1) a mission-critical software business where merchants can control all of their business operations from one dashboard and 2) a payments business with a long runway to increase onboarding rates and grow alongside merchants. In addition, we believe the company has significant options to continue to onboard existing merchant solutions and add more merchant services as high-margin cross-sells. With several strong tailwinds behind them (e-commerce, mobile commerce, social media, digital payments, seamless omnichannel strategy, DTC, cloud software digitization) and a highly scalable business model, we believe their growth is likely to be stronger for longer than investors expect.”

Overall, Shopify Inc (NYSE:SHOP) ranks 5th on Insider Monkey’s list of the titled Jim Cramer talks about these 10 stocks as the market recovers. While we recognize the potential of Shopify Inc (NYSE:SHOP), we believe AI stocks promise higher returns and do so in a shorter period of time. If you are looking for an AI stock that is more promising than SHOP but trades at less than 5 times its earnings, read our report on the cheapest AI stock.

READ MORE: Analyst sees a new $25 billion “opportunity” for NVIDIA And Jim Cramer recommends these stocks.

Disclosure: None. This article was originally published on Insider Monkey.