On August 26, 2024, Patrick Lytle, Vice President – Chief Accounting Officer of SM Energy Co (NYSE:SM), completed a sale of 6,059 shares of the company’s stock. The transaction was documented in an SEC filing. Following this transaction, the insider now owns 8,005 shares of SM Energy Co.

SM Energy Co is an independent energy company engaged in the procurement, exploration, development and production of crude oil, natural gas and natural gas liquids in North America.

SM Energy Co’s share price was $47.45 on the day of the transaction. The company’s market capitalization is around $5.27 billion. Its price-to-earnings ratio is 6.63, below the industry average of 10.935, suggesting a potentially lower valuation compared to peers.

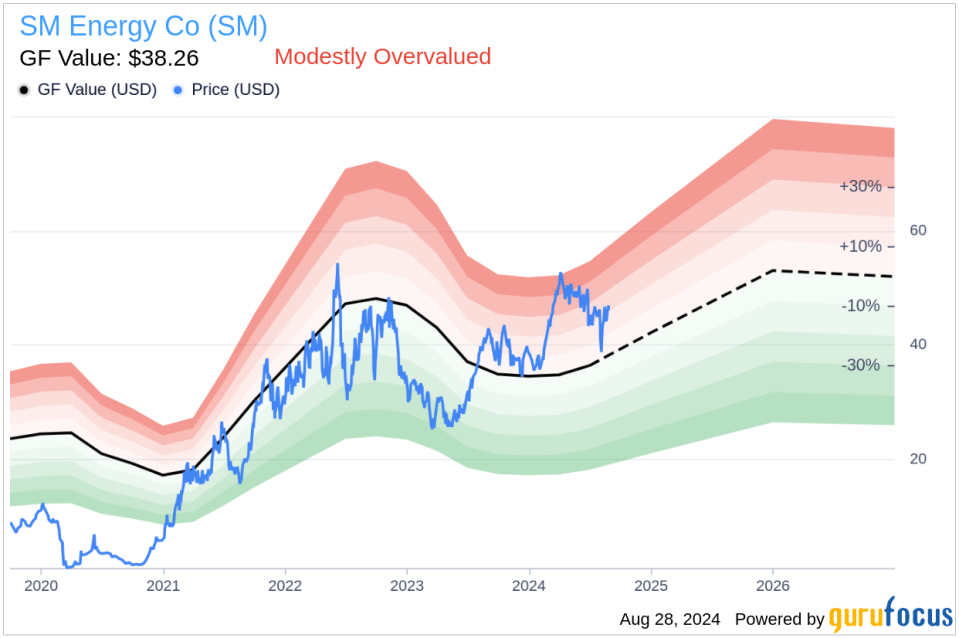

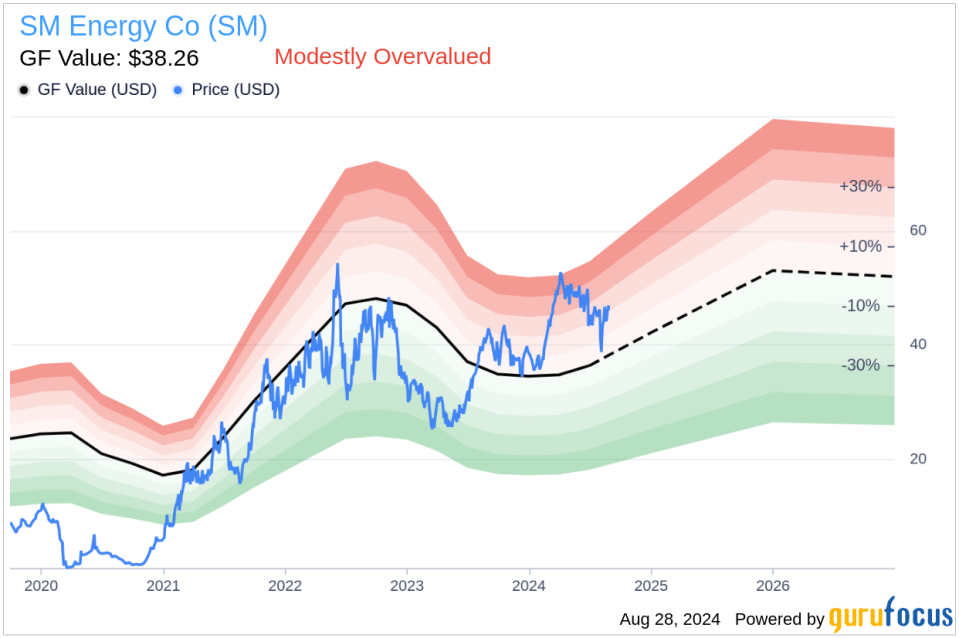

SM Energy Co’s GF Value is $38.26, resulting in a Price to GF Value ratio of 1.24, which suggests the stock is slightly overvalued. The GF Value is calculated by taking into account historical trading multiples, an adjustment factor based on past earnings and growth, and future business performance estimates by analysts.

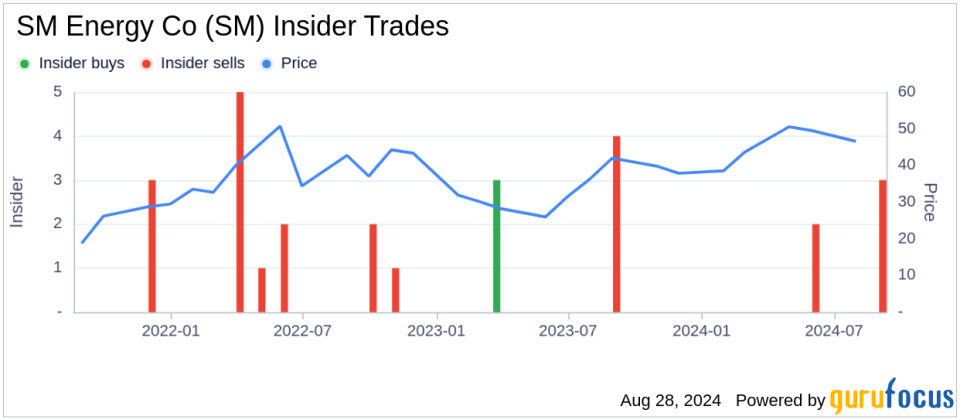

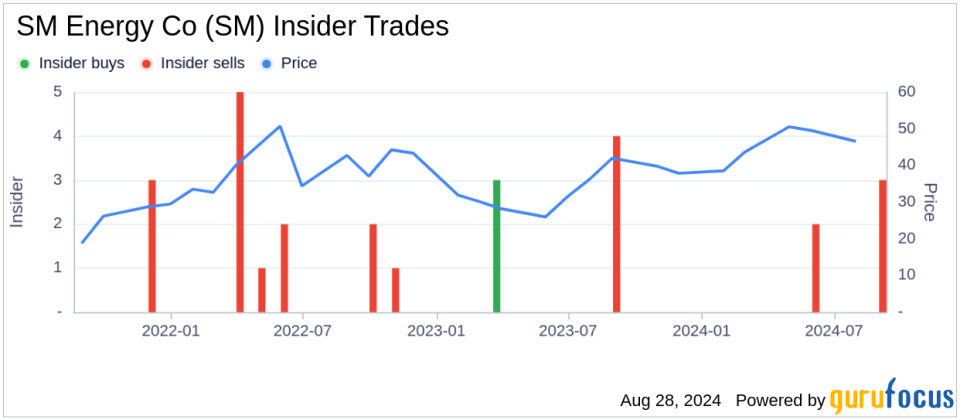

SM Energy Co’s insider transaction history shows no insider purchases in the past year, with a total of 7 insider sales, indicating a trend of insider selling.

This recent sale by Patrick Lytle is in line with the general trend of insider selling observed at SM Energy Co over the past year. Investors and shareholders should pay attention to this trend when evaluating the company’s stock performance and insider confidence.

This article created by GuruFocus is intended to provide general insights and does not constitute tailored financial advice. Our commentary is based on historical data and analyst forecasts, uses an unbiased methodology and is not intended to serve as specific investment advice. It does not contain a recommendation to buy or sell any stock and does not take into account any individual investment objectives or financial circumstances. Our goal is to provide long-term, fundamental, data-driven analysis. Note that our analysis may not include the most recent, price-sensitive company announcements or qualitative information. GuruFocus does not hold a position in any stocks mentioned here.

This article first appeared on GuruFocus.