Walmart Inc. WMT is expected to report revenue and earnings growth when it reports its second quarter fiscal 2025 results on August 15. The Zacks Consensus Estimate for revenue is $168.43 billion, up 4.2% from the year-ago period.

The consensus earnings estimate has remained unchanged at 65 cents per share over the past 30 days, representing growth of 6.6% from the year-ago quarter. WMT has averaged an earnings surprise of 8.3% over the past four quarters.

Walmart Inc. Price, Consensus and EPS Surprise

Walmart Inc. Price Consensus EPS Surprise Chart | Walmart Inc. Quote

What the Zacks model reveals

Our proven model does not conclusively predict that Walmart will beat its earnings estimate this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings estimate beat, which is not the case here. You can see You can find the complete list of today’s Zacks #1 Rank stocks here.

Although Walmart currently has a Zacks Rank #2, its Earnings ESP is -0.93%. You can use our Earnings ESP filter to find the best stocks to buy or sell before they are reported.

Factors to consider

Walmart is benefiting from the strength of its highly diversified business, with contributions spanning various segments, markets, channels and formats. The company is seeing an increase in customer traffic in both stores and digital channels, reflecting its deft navigation of the evolving retail landscape. The company’s commitment to innovation and adaptability, particularly in e-commerce, has been a key driver. Gains from higher-margin ventures such as advertising are also notable. Such positive developments are likely to impact second-quarter results.

A strong omnichannel business has worked well for Walmart. The integration of online and offline channels, including services such as in-store pickup, same-day delivery, and shipping options, has helped provide a seamless shopping experience to customers both domestically and internationally. In addition, the company has taken several measures to expand its merchandise assortment. These strategies strengthen Walmart’s competitive advantage and enable the company to reach a wider customer base and achieve higher sales.

Many other retailers like Kroger KR, Costco COST and Goal TGT has also sharpened its omnichannel presence to stay in the game.

Back to Walmart, the company’s strategic investments in technology and e-commerce have made it a serious competitor in the online retail space. Initiatives such as Walmart GoLocal, Walmart Luminate, Walmart Connect and Sam’s Club MAP demonstrate Walmart’s commitment to improving the customer experience and operational efficiency.

In addition, Walmart’s delivery capabilities and services have set a new standard in retail logistics by combining efficiency with customer-focused innovation. With its Walmart+ membership program and services such as Express Delivery, the company has strengthened its delivery capabilities, which have been a key driver of e-commerce.

In the first quarter of fiscal 2025, global e-commerce sales at pickup and delivery stores and the marketplace grew 21% and accounted for 18% of Walmart’s total net sales. E-commerce penetration increased in all markets. The continuation of this trend is likely to have boosted Walmart’s performance in the second quarter and helped the company counteract high operating costs.

Price development & valuation

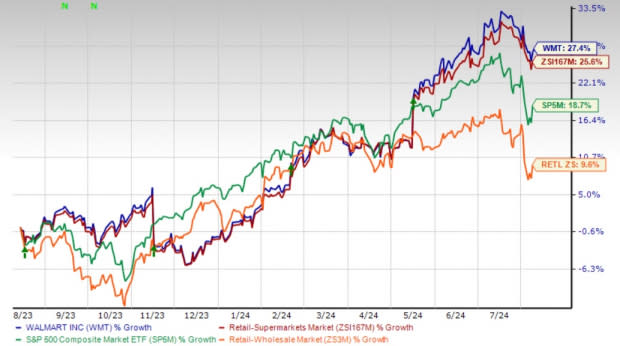

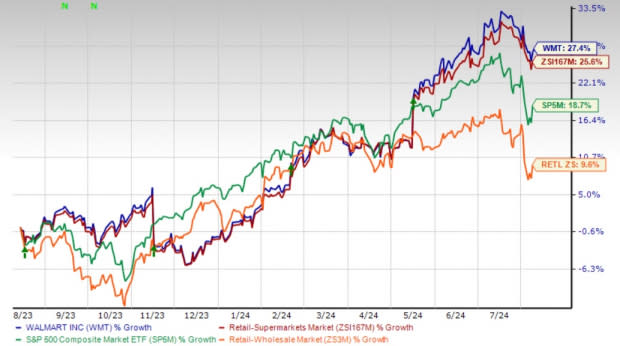

Walmart’s unmatched scale and operational prowess have helped it outperform the industry and the broader market over the past year. Shares of this omnichannel retailer have risen 27.4% in a year compared to the industry’s growth of 25.6%. The broader Zacks Retail-Wholesale sector and the S&P 500 have posted gains of 9.6% and 18.7%, respectively, over the same period.

Image source: Zacks Investment Research

Walmart currently trades at a 12-month forward P/E of 26.56, above the industry average of 24.87 and the S&P 500 of 20.65. We believe this higher valuation reflects the company’s successful track record and investors’ willingness to pay for the expected growth and stability.

Image source: Zacks Investment Research

Investment thesis

Walmart has long been considered a titan in retail. The company’s robust omnichannel approach seamlessly integrates its extensive brick-and-mortar presence with a thriving e-commerce platform, serving a broad range of consumer preferences. A key element of Walmart’s success is its diversification strategy, reaching beyond traditional retail into areas such as advertising to create new revenue streams.

In addition, the company’s business stability, backed by strong financial health, underscores its commitment to delivering consistent returns to shareholders. With its multi-pronged growth strategies and unwavering commitment to excellence, Walmart is well positioned to continue its upward trajectory, making it an attractive choice for investors right now.

Stay up-to-date on upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Download the 7 best stocks for the next 30 days today. Click here to get this free report

Target Corporation (TGT): Free Stock Analysis Report

Walmart Inc. (WMT): Free Stock Analysis Report

The Kroger Co. (KR): Free Stock Analysis Report

Costco Wholesale Corporation (COST): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research