We recently published a list of The 10 best automation stocks to buy nowIn this article, we will look at how QUALCOMM Incorporated (NASDAQ:QCOM) compares to the other automation stocks.

2023 was the year of generative AI, largely due to the widespread adoption of ChatGPT and the resulting response. Now 2024 is the year when companies have really started to leverage this ever-evolving technology. McKinsey has found that AI helps companies in both aspects: reducing costs and increasing revenue.

Automation technologies – key trends

In 2024, the integration of automation technologies continues to revolutionize every aspect of supply chain management, leading to unprecedented levels of efficiency and agility. According to industry data from Market.us, the global integrated automated supply chain is expected to grow from $13.4 billion in 2023 to $25.6 billion by 2033.

From eliminating warehousing bottlenecks to inventory management and demand forecasting, supply chain automation has transformed traditional practices and redefined the dynamics of the logistics industry. When it comes to inventory tracking, advanced warehouse management systems powered by AI and ML algorithms focus on optimizing inventory placement, route planning, resource allocation, etc.

Inventory tracking and management is being revolutionized by the use of automation solutions such as RFID tagging, barcode scanning and computer vision. Real-time tracking technologies provide detailed insights into inventory movements. This enables companies to monitor inventory levels, detect deviations and manage under/overstocks. Manufacturers are now moving towards smart factories.

Smart factories reflect and demonstrate the principles of Industry 4.0. They typically use 5G, IoT, AI and other advanced technologies. Experts believe that smart factories enable predictive maintenance and decision-making.

Introducing advanced automation

A new theme is emerging in the field of automation: automated decision making. Its application has rapidly expanded beyond traditional industries such as manufacturing and logistics. The need for decision intelligence arises from data-driven and well-informed decision-making requirements that increase the competitiveness and efficiency of companies.

Automated decision making is now accepted in major sectors such as healthcare and finance. In healthcare, automation complements clinical decision-making processes, improves patient care, and manages resource allocation by leveraging AI and ML algorithms to evaluate patient data, medical images, and genome sequences to tailor patient care.

In finance, too, automated systems continue to transform best-in-class operations such as risk assessment, fraud detection, and investment management. AI algorithms evaluate large data sets of financial transactions and market trends to optimize investment strategies. In 2024, the software development industry is poised for a remarkable transformation with groundbreaking innovations.

Quantum computing and robotics

The latest software technologies expected to reshape the landscape include quantum computing, virtual reality (VR), augmented reality (AR), Big data, data analytics, 5G technology, robotics, etc.

Quantum computing continues to evolve rapidly and change the scientific and industrial landscape. Unlike classical computers, which use bits as the smallest unit of information, quantum computers use qubits, which use the principles of quantum mechanics to perform complex and difficult calculations. For example, in drug discovery, quantum algorithms simulate molecular interactions more accurately and sophisticatedly than traditional methods. The integration of quantum computing into AI is another important new trend.

The unprecedented advancements in robotics and AI are expected to bring revolutionary positive changes. More and more industries are realizing the benefits of adopting robotics and AI. Globally, the robotics market is expected to witness healthy revenue growth and reach a projected value of $38.24 billion this year. The strongest segment in the robotics market is expected to be service robotics, which is expected to lead the market volume. Service robotics finds application in industries such as healthcare, medical, military & defense, logistics, etc., while industrial robots are used in automotive, electronics, food & beverage, etc.

The trends driving the robotics market are supported by developments in new technologies. These include 5G, AI, edge computing, IIoT, cloud, open source, etc. As AI in robotics advances, more and more industries are using the latest technologies. Therefore, manufacturers are making data-driven decisions. Some industries are using self-learning robots to perform work processes.

Smart factories use AI-powered robots to perform smarter, more reliable and efficient processes. They help in production optimization. AI-powered robot technologies, including computer vision and tactile sensing, are used to automate certain tasks. For example, reinforcement learning is used for better industrial assembly. The use of robots, intelligent automation and high-tech manufacturing will help workers with manual labor and reduce repetitive tasks.

At Insider Monkey, we’re obsessed with the stocks hedge funds invest in. The reason is simple: Our research shows we can outperform the market by mimicking the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks each quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points. (Further details can be found here).

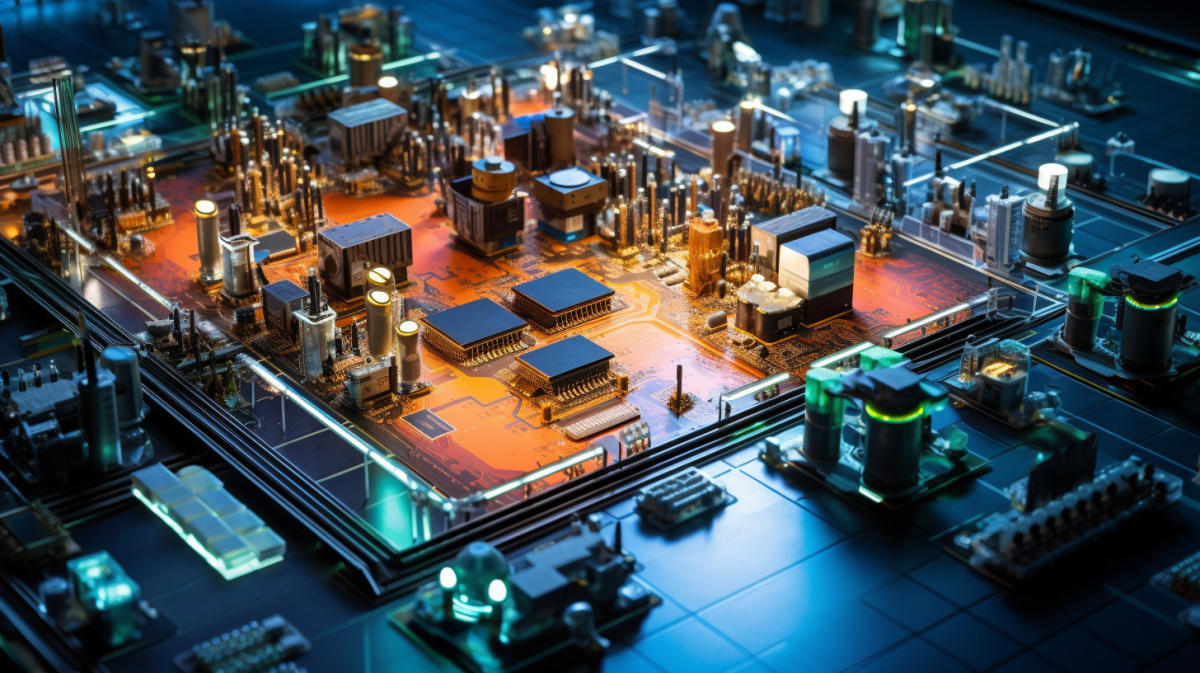

An aerial view of a busy semiconductor production area showcasing the company’s integrated circuits.

QUALCOMM Incorporated (NASDAQ:QCOM)

Average upside potential: 30.71%

QUALCOMM Incorporated (NASDAQ:QCOM) is a multinational semiconductor and telecommunications equipment company engaged in the development and delivery of digital wireless communications products and services.

The Qualcomm Al Engine is the application of computer vision in AI. This optimizes tasks such as object detection, facial recognition, etc. In particular, smartphones, IoT devices, automotive systems, and augmented reality (AR) are some of the examples where such technologies are used. QUALCOMM Incorporated (NASDAQ:QCOM) has leveraged catalysts to change its business mix.

This was made clear by the announcement that the company had made progress in solutions for the automotive industry and the Internet of Things (IoT). The company’s stock is benefiting from two main factors. First, there are early signs of a recovery in the smartphone market. Second, there is increasing optimism that the generative AI trend should contribute to increasing smartphone sales.

For the fourth quarter of 2024, the company expects revenue in the range of $9.5 billion to $10.3 billion and diluted earnings per share (GAAP) of $2.38 to $2.58. Wall Street analysts believe QUALCOMM Incorporated’s (NASDAQ:QCOM) automotive business has good momentum, with semiconductors playing a larger role in the transportation industry amid trends such as electrification and autonomous driving.

Analysts at Bank of America have initiated coverage on shares of QUALCOMM Incorporated (NASDAQ:QCOM). The brokerage house increased its price target from $180.00 to $245.00 and issued a “buy” rating on the stock on March 31.st May.

According to Insider Monkey, 78 hedge funds held shares of QUALCOMM Incorporated (NASDAQ:QCOM) at the end of Q1 2024.

O’keefe Stevens Consultingan investment advisory firm, has released its investor letter for the second quarter of 2024. Here is what the fund said:

“During the quarter, the AI boom expanded beyond the obvious players of Nvidia, AMD and hyperscalers. QUALCOMM Incorporated “Qualcomm Corp. (NASDAQ:QCOM), a long-term investment, is gaining recognition for integrating artificial intelligence into mobile phones. Qualcomm’s on-device AI capabilities enable real-time language translation, enhanced speech recognition, and sophisticated imaging techniques as AI becomes more integral to mobile experiences. Qualcomm benefits from leading the market in delivering robust, efficient, and versatile AI solutions. AI could be the first technological advancement in several years to accelerate the smartphone replacement cycle as users demand these advanced features.”

Overall, QCOM 6th place on our list of the best automation stocks to buy. While we recognize QCOM’s potential as an investment, we believe AI stocks promise higher returns and do so in a shorter time frame. If you’re looking for an AI stock that’s more promising than QCOM but trades at less than 5x earnings, read our report on the cheapest AI stock.

READ MORE: $30 trillion opportunity: The 15 best humanoid robot stocks to buy, according to Morgan Stanley And According to Jim Cramer, NVIDIA has “become a wasteland”.

Disclosure: None. This article was originally published on Insider Monkey.