T-Mobile (NASDAQ:TMS) showed it is on a path to further growth after reporting its second-quarter 2024 results on July 31. While it may be difficult to call it a “growth company” after these results, its growing net accounts and net customer additions point to continued expansion.

But after years of outperforming the competition, AT&T And Verizonit no longer delivers the highest returns in the industry. Does this mean it’s time for investors to turn away from T-Mobile stock?

T-Mobile’s results

Given its size, however, T-Mobile is not posting the numbers that would have made it a growth stock in the past. In the first half of the year, revenue of $39 billion was up just 2% compared to the same period in 2023.

Nevertheless, the company managed to reduce operating expenses by three percent during this period. This was enough to increase net profit to $5.3 billion in the first six months of the year, an increase of 27 percent over the previous year.

In addition, free cash flow for the first half of 2024 was $7.8 billion, up 48% for the year. An increase in operating cash flow and lower equipment spending more than offset lower proceeds from securitization transactions.

The improving financial situation enabled T-Mobile to pay an annual dividend of $2.60 per share starting in December last year. Although the dividend yield of 1.4% was S&P500 With an average dividend yield of 1.4%, the company lags behind Verizon and AT&T, which offer dividend yields of 6.5% and 5.7%, respectively.

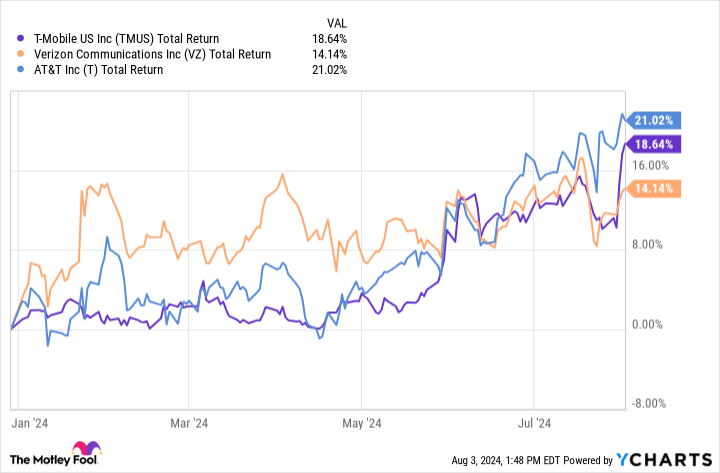

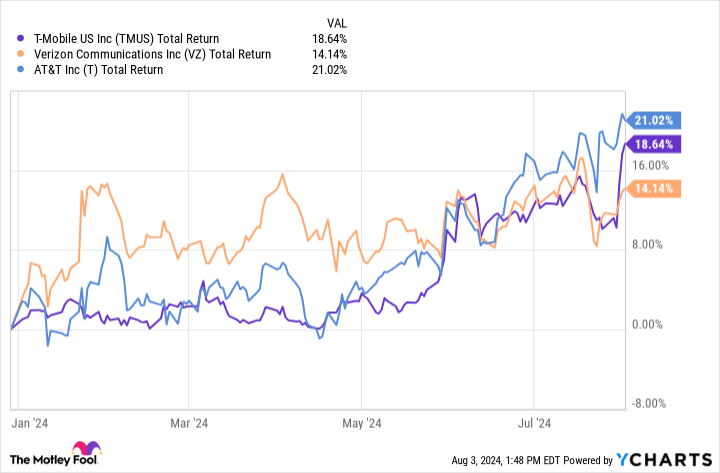

The bad news for T-Mobile investors is that shortly after the dividend announcement, stock performance was similar to that of its main competitors. When dividends are included, AT&T is now the highest-yielding stock among its peers, outperforming only Verizon, which has been increasing its payout for 17 years but faces a crushing $149 billion in debt.

T-Mobile shares on the rise

Does this mean that investors should dump T-Mobile shares in favor of AT&T? After all, AT&T pays a dividend that attracts income-seeking investors, and its P/E ratio of 11 is well below T-Mobile’s earnings multiple of 24.

However, T-Mobile seems to stand out in terms of dividend-paying ability. The company’s free cash flow would be nearly $16 billion if it generates the same level of free cash flow over the next two quarters. This is only a small fraction of the $3 billion that T-Mobile must pay in dividends this year.

In addition, T-Mobile has $80 billion in debt, including $5.9 billion in short-term debt, allowing the company to pay off its short-term debt without having to raise cash or cut its dividend.

This is unlikely to be the case for AT&T, which has $130 billion in total debt. About $5 billion of that debt is coming due this year, and it looks like the company will have dividend costs of about $8 billion for the year. AT&T can probably cover those costs, as the company expects free cash flow to be between $17 billion and $18 billion in 2024.

Still, AT&T remains under an even greater debt burden and has little ability to pay down its long-term debt quickly, leaving the company less prepared to respond to changes in the market without at least cutting its dividend.

Should investors sell T-Mobile shares?

Given T-Mobile’s financials, the company is likely to be the best performing telecom stock over the long term. As mentioned, Verizon has chronically underperformed its peers.

As for AT&T, a stock price recovery and high dividends have pushed the company’s annual earnings above those of T-Mobile. Unfortunately, AT&T’s massive debt load means it has relatively little ability to reduce its long-term debt, which in turn could limit the company’s ability to respond to changes in the market without cutting dividends.

Admittedly, T-Mobile stock’s growth could slow as it matures into a more mature stock, but if conditions remain challenging, the stock is best positioned to maintain its dividend and deliver the highest long-term returns.

Should you invest $1,000 in T-Mobile US now?

Before you buy T-Mobile US stock, consider the following:

The Motley Fool Stock Advisor The analyst team has just published what they believe to be The 10 best stocks for investors to buy now… and T-Mobile US wasn’t among them. The 10 stocks that made the cut could deliver huge returns in the years to come.

Consider when NVIDIA created this list on April 15, 2005… if you had invested $1,000 at the time of our recommendation, You would have $643,212!*

Stock Advisor offers investors an easy-to-understand plan for success, including instructions on how to build a portfolio, regular updates from analysts, and two new stock recommendations per month. The Stock Advisor Service has more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of August 6, 2024

Will Healy does not own any stocks mentioned. The Motley Fool recommends T-Mobile US and Verizon Communications. The Motley Fool has a disclosure policy.

Is T-Mobile Still the Best Telecom Stock? was originally published by The Motley Fool