David Iben put it well when he said, “Volatility is not a risk we care about. What we care about is avoiding permanent loss of capital.” It is only natural to consider a company’s balance sheet when examining how risky it is, since debt is often involved when a company collapses. We find that Mondelez International, Inc. (NASDAQ:MDLZ) has debt on its balance sheet. But the real question is whether that debt makes the company a risky company.

What risks are associated with debt?

Debt helps a company until it struggles to pay it back with either fresh capital or free cash flow. In the worst case scenario, a company can go bankrupt if it can’t pay its creditors. More common (but still costly), however, is that a company must issue shares at bargain prices, permanently diluting its shareholder base, just to shore up its balance sheet. Of course, many companies use debt to fund growth without negative consequences. When considering how much debt a company has, you should first look at its cash and debt together.

Check out our latest analysis for Mondelez International

How much debt does Mondelez International have?

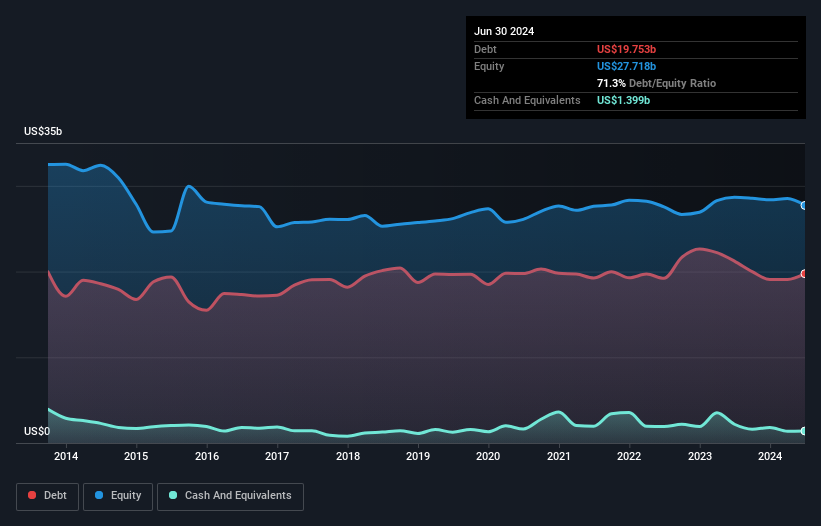

As you can see below, Mondelez International had $19.8 billion in debt as of June 2024, up from $21.2 billion a year earlier. However, this compares to $1.40 billion in cash, resulting in net debt of approximately $18.4 billion.

A look at Mondelez International’s liabilities

According to the most recent balance sheet data, Mondelez International had liabilities of $22.4 billion due within a year and liabilities of $22.9 billion due thereafter, compared with $1.40 billion in cash and $4.01 billion in receivables due within 12 months. So the company’s liabilities total $40.0 billion more than its cash and short-term receivables combined.

This deficit is not so bad, as Mondelez International is worth a whopping $93.9 billion and could therefore probably raise enough capital to stabilize its balance sheet if the need arose. Nevertheless, it is worth taking a close look at the group’s ability to repay debt.

To quantify a company’s debt relative to its earnings, we calculate its net debt divided by its earnings before interest, taxes, depreciation, and amortization (EBITDA) and its earnings before interest and taxes (EBIT) divided by its interest expense (its interest cover). This way, we take into account both the absolute amount of debt and the interest rates paid on it.

Mondelez International’s net debt to EBITDA ratio of around 2.3 suggests only moderate use of debt. And its strong interest coverage of 13.4 times gives us even more reassurance. We note that Mondelez International grew its EBIT by 21% over the last year, which should make debt repayment easier going forward. When analyzing debt levels, the balance sheet is the obvious place to start. But ultimately, the company’s future profitability will determine whether Mondelez International can strengthen its balance sheet over time. So if you’re focused on the future, you can look at free Report with analysts’ profit forecasts.

After all, a company can only pay off its debt with cold hard cash, not accounting profits, so we need to make sure that EBIT is leading to free cash flow to match. Over the last three years, Mondelez International reported free cash flow equal to 58% of its EBIT, which is about normal given that free cash flow excludes interest and tax. This cold hard cash means that the company can pay down its debt if necessary.

Our view

Fortunately, Mondelez International’s impressive interest coverage suggests that the company has its debt under control. And that’s not all the good news, as its EBIT growth rate also supports this impression! Looking at all of the above factors together, we find that Mondelez International can manage its debt relatively easily. Of course, this debt can increase return on equity, but it also brings with it more risk, so it’s worth keeping an eye on this factor. When analyzing debt levels, the balance sheet is the obvious place to start. However, not all investment risks can be found on the balance sheet – quite the opposite. For example, we found that 1 warning signal for Mondelez International that you should know before investing here.

If you are interested in investing in companies that can grow profits without the burden of debt, check this out free List of growing companies that have net cash on their balance sheet.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.