Some say that volatility, not debt, is the best way to think about risk as an investor, but Warren Buffett once said, “Volatility is far from synonymous with risk.” So it may be obvious that you need to consider debt when thinking about how risky a particular stock is, because too much debt can ruin a company. We find that PDD Holdings Inc. (NASDAQ:PDD) has debt on its balance sheet. But the real question is whether that debt makes the company a risky company.

What risks are associated with debt?

Debt is a tool to help businesses grow, but if a company is unable to repay its lenders, it is at their mercy. If things go really bad, lenders can take control of the company. A more common (but still costly) case, however, is that a company must issue stock at bargain prices, permanently diluting shareholder ownership, just to shore up its balance sheet. By replacing dilution, however, debt can be an extremely good tool for companies that need capital to invest in high-return growth. When considering how much debt a company takes on, you should first look at its cash and debt together.

Check out our latest analysis for PDD Holdings

How much debt does PDD Holdings have?

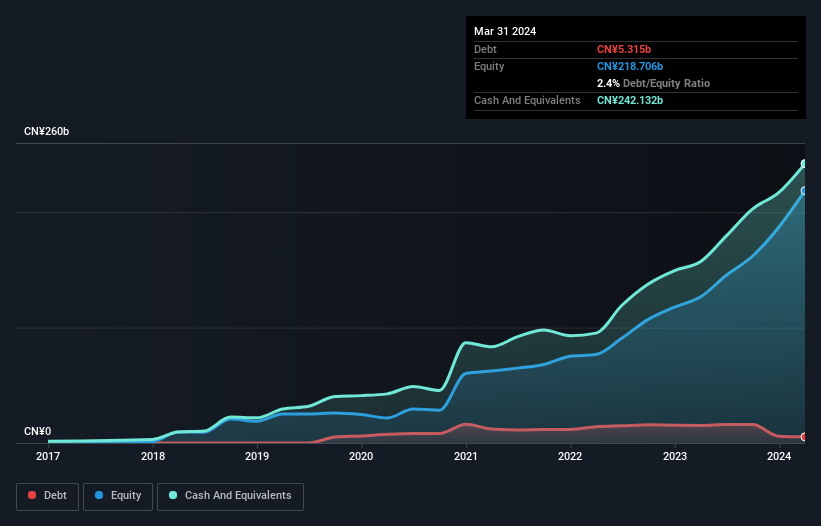

The image below, which you can click on for more details, shows that PDD Holdings had CN¥5.31 billion in debt at the end of March 2024, a reduction of CN¥15.3 billion year-over-year. However, to offset this, the company also has CN¥242.1 billion in cash, meaning it has net cash of CN¥236.8 billion.

How strong is PDD Holdings’ balance sheet?

If we take a closer look at the most recent balance sheet data, we can see that PDD Holdings had CN¥151.4bn of liabilities due within 12 months and CN¥7.72bn of liabilities beyond that. Against this, it had CN¥242.1bn in cash and CN¥11.7bn in receivables due within 12 months. So the company can boast CN¥94.8bn more cash than in total Liabilities.

This short-term liquidity is a sign that PDD Holdings could probably easily repay its debts, as its balance sheet is far from overextended. In short, PDD Holdings has net cash flow, so it’s fair to say that the company does not have a high debt burden!

Even more impressive was the fact that PDD Holdings was able to grow its EBIT by 121% over twelve months. If this growth continues, debt will become even more manageable in the years to come. There is no doubt that we learn the most about debt from the balance sheet. But it is future earnings, more than anything, that will determine whether PDD Holdings can maintain a healthy balance sheet in the future. So if you want to know what the professionals think, you might find this free report on analyst profit forecasts interesting.

After all, a company can only pay off its debt with cold hard cash, not accounting profits. While PDD Holdings has net cash flow on the balance sheet, it’s still interesting to see how well the company converts its earnings before interest and tax (EBIT) to free cash flow, as this impacts both its need for debt and its ability to manage it. Fortunately for all shareholders, PDD Holdings actually generated more free cash flow than EBIT over the past three years. There’s nothing like cash when it comes to staying in the good graces of lenders.

Summary

While it always makes sense to examine a company’s debt, in this case PDD Holdings has CNY236.8b in cash and a decent looking balance sheet. The icing on the cake was that 152% of that EBIT was converted to free cash flow, bringing in CNY113b. Therefore, we don’t think PDD Holdings’ use of debt is risky. When analyzing debt levels, the balance sheet is the obvious place to start. However, not all investment risks can be found on the balance sheet – quite the opposite. For example, we found that 1 warning signal for PDD Holdings that you should know before investing here.

If, after all that, you’re more interested in a fast-growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.