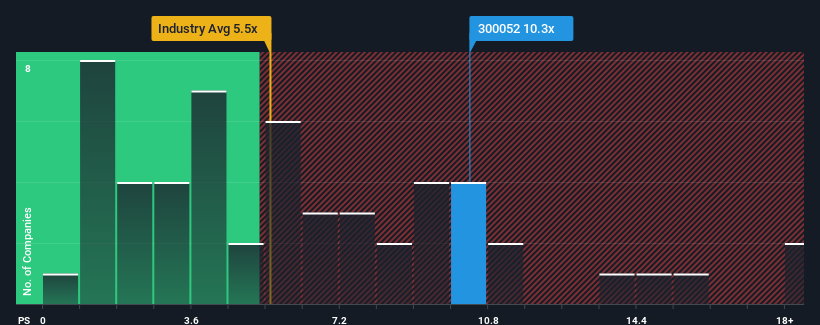

Considering that nearly half of the entertainment companies in China have a price-to-sales ratio (or “P/S”) of less than 5.5x, Shenzhen Zqgame Co., Ltd (SZSE:300052) appears to be sending strong sell signals with its 10.3x P/S ratio. Still, we would have to dig a little deeper to determine if there is a rational basis for the sharply elevated P/S.

Check out our latest analysis for Shenzhen Zqgame

What does Shenzhen Zqgame’s P/S mean for shareholders?

With revenue growth that has lagged behind most other companies recently, Shenzhen Zqgame has been relatively sluggish. Perhaps the market is expecting future revenue trends to reverse, which has increased the P/S ratio. You would really hope so, otherwise you’re paying a pretty high price for no particular reason.

Do you want the full picture of analyst estimates for the company? Then our free The report on Shenzhen Zqgame will help you find out what awaits us on the horizon.

Is Shenzhen Zqgame forecast to have sufficient revenue growth?

Shenzhen Zqgame’s P/S ratio is typical of a company that is expected to deliver very strong growth and, more importantly, significantly outperform the industry.

Looking back, last year the company had practically the same revenue as the year before. While this is an improvement, it was not enough to get the company out of the hole it was in. Overall, revenue fell by 12% compared to the previous year. So we have to admit that the company did not achieve much revenue growth during this time.

As for the outlook, the only analyst covering the company estimates that next year will bring 9.9% growth, well below the 24% growth forecast for the industry as a whole.

With that in mind, it’s alarming that Shenzhen Zqgame’s P/S is higher than most other companies. It seems that many of the company’s investors are much more optimistic than analysts indicate and aren’t willing to unload their shares at any price. There’s a good chance that these shareholders are setting themselves up for future disappointment if the P/S falls to a level more in line with the growth prospects.

The last word

It’s not a good idea to use the price-to-sales ratio alone to decide whether to sell your stock, but it can be a useful guide to the company’s future prospects.

Although analysts are forecasting below-industry revenue growth for Shenzhen Zqgame, this does not seem to have the slightest impact on its P/S. The company’s weak revenue forecast does not bode well for its elevated P/S, which could decline unless sales sentiment improves. Unless these conditions improve significantly, it is very difficult to accept these prices as reasonable.

You should always think about the risks. A typical example: We have 3 warning signs for Shenzhen Zqgame You should be aware of this, and one of them makes us a little uncomfortable.

If you are looking for companies with solid earnings growth in the pastyou might want to see this free Collection of other companies with strong earnings growth and low P/E ratios.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.