Shizuoka Gas Co., Ltd. (TSE:9543) announced that it will increase its dividend on March 28 from last year’s dividend to 27.00 yen. This brings the annual dividend payment to 2.7% of the share price, higher than what most companies in the industry pay.

Check out our latest analysis for Shizuoka Gas

Shizuoka Gas’s earnings easily cover the distributions

While an impressive dividend yield is good, that doesn’t matter so much if the payments can’t be maintained. Before this announcement, Shizuoka Gas was easily earning enough to cover the dividend. This means that the majority of the company’s earnings are being used to support its growth.

Next year, earnings per share are expected to grow by 2.4%. Assuming the dividend stays the same, we believe the payout ratio next year could be 50%, which is in a fairly sustainable range.

Shizuoka Gas has a solid track record

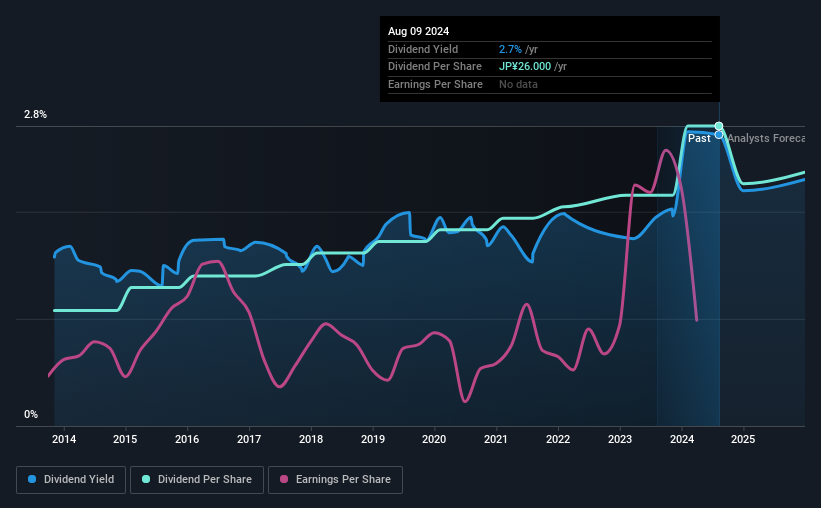

The company has a long history of paying dividends, and these are quite stable, which gives us confidence in future dividend potential. The annual payment over the past 10 years was ¥10.00 in 2014, and the payment in the last fiscal year was ¥26.00. This means that payouts have grown by 10% annually during this time. We can see that payments have shown very nice upward momentum without stalling, which gives us some confidence in the reliability of future payments.

The dividend is likely to increase

Investors who have held shares in the company over the past few years will be pleased with the dividend income they have received. It is encouraging to see that Shizuoka Gas has grown earnings per share by 18% per year over the past five years. Given decent growth and a low payout ratio, we believe this bodes well for Shizuoka Gas’s prospects of increasing its dividend payments in the future.

Shizuoka Gas seems to be a great dividend stock

Overall, we think this could be an attractive dividend stock, and it will get even better by paying a higher dividend this year. The company easily earns enough to cover its dividend payments, and it’s great to see those earnings being converted into cash flow. All in all, this meets many of the criteria we look for when choosing a dividend stock.

It is important to note that companies with a consistent dividend policy generate more confidence among investors than those with an irregular one. However, despite the importance of dividend payments, they are not the only factors our readers should know when evaluating a company. For example, we have selected the following companies: 1 warning sign for Shizuoka Gas investors should know before investing capital in this stock. If you are a dividend investor, you may also want to take a look at our curated list of high dividend stocks.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.