Shopify Inc. (NYSE:SHOP) shares were strong after recently reporting robust earnings. We’ve done some analysis and believe investors are missing some details hidden behind the earnings numbers.

Check out our latest analysis for Shopify

The impact of unusual items on profit

For anyone looking to understand Shopify’s profit beyond the statutory numbers, it’s important to know that statutory profit over the last twelve months came from US$436 million worth of unusual items. We can’t deny that higher profits generally make us optimistic, but we would have preferred the profit to be sustainable. We’ve checked the numbers for most listed companies globally, and it’s very common for unusual items to be one-off in nature. And that’s to be expected, given that these increases are described as ‘unusual’. We can see that Shopify’s positive unusual items in the year to June 2024 were quite significant relative to its profit. All else remaining unchanged, this would likely result in statutory profit being a poor indicator of underlying earnings power.

You may be wondering what analysts are predicting in terms of future profitability. Fortunately, you can click here to see an interactive chart depicting future profitability based on their estimates.

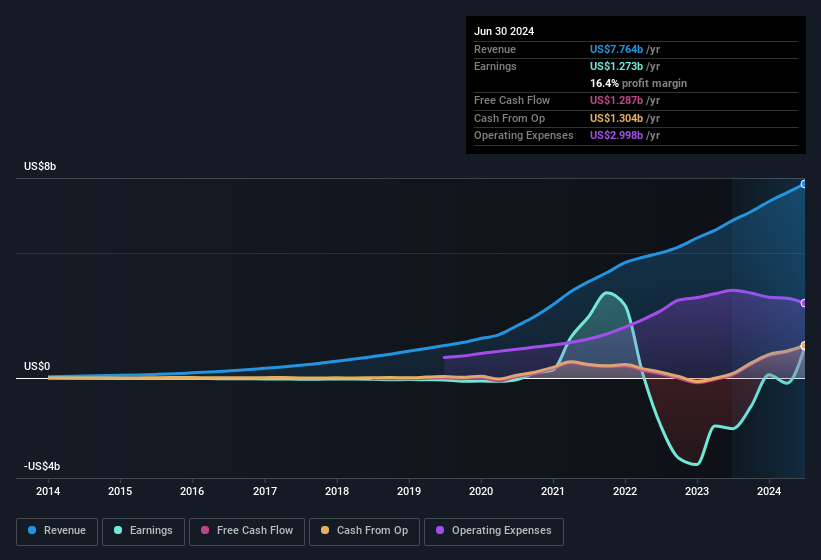

Our assessment of Shopify’s earnings development

As we discussed above, we believe that the significant positive unusual item makes Shopify’s earnings a poor indicator of underlying profitability. Therefore, we believe it’s quite possible that Shopify’s underlying earnings power is lower than its statutory profit. On the positive side, the company has shown enough improvement to post a profit this year after losing money last year. Of course, we’ve only just scratched the surface when analyzing earnings; one could also consider margins, forecast growth, and return on capital, among other things. While the quality of earnings is important, it’s equally important to consider the risks Shopify faces at this point. At Simply Wall St, we found 2 warning signs for Shopify and we think they deserve your attention.

Today we’ve focused on a single data point to better understand the nature of Shopify’s earnings. But there are many other ways to form an opinion about a company. For example, many people view a high return on equity as an indication of favorable business conditions, while others like to “follow the money” and look for stocks that insiders are buying. Although this may require a little research, you may find that free Collection of companies with high return on equity or this list of stocks with significant insider holdings may prove useful.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.