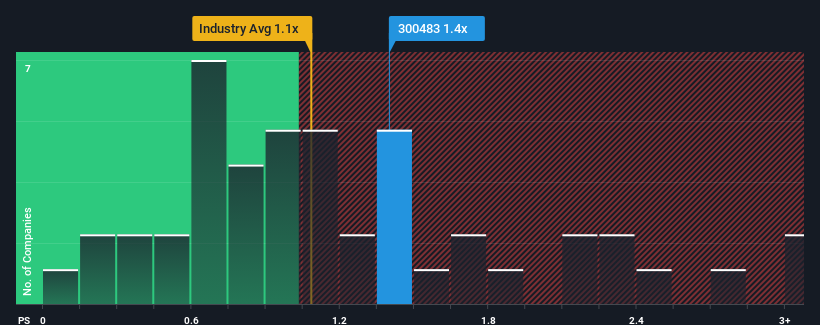

With a median price-to-sales ratio (or “P/S”) of nearly 1.1 in the oil and gas industry in China, you could be forgiven for being indifferent to Sino Prima Gas Technology Co., Ltd. (SZSE:300483) P/S ratio of 1.4x. However, investors could miss a clear opportunity or a potential pullback if there is no rational basis for the P/S.

Check out our latest analysis for Sino Prima Gas Technology

How has Sino Prima Gas Technology developed recently?

For example, consider that Sino Prima Gas Technology’s financial performance has been poor recently as revenue has been declining. One possibility is that the P/S is modest because investors believe the company could still do enough in the near future to keep up with the broader industry. If you like the company, you at least hope that’s the case so you can potentially buy some shares while it’s not exactly popular.

Although there are no analyst estimates for Sino Prima Gas Technology, take a look at these free Data-rich visualization to see how the company is performing in terms of profit, revenue and cash flow.

What do the sales growth metrics tell us about the P/S?

Sino Prima Gas Technology’s price-to-sales ratio would be typical of a company that is expected to deliver only moderate growth and, importantly, perform in line with the industry.

Looking back, last year saw a frustrating 35% drop in revenue. This means that revenue has also declined in the long run, as revenue has declined by 25% overall over the last three years. So we’re sad to admit that the company hasn’t seen much revenue growth during that time.

If you compare this medium-term sales development with the one-year forecast for the entire industry, which assumes growth of 5.5 percent, this is not a good prospect.

With this in mind, we find it troubling that Sino Prima Gas Technology’s P/S is outperforming that of its industry peers. It appears that many of the company’s investors are far less pessimistic than its recent history would suggest and are not willing to offload their shares at this time. There’s a good chance that existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent negative growth rates.

What can we learn from Sino Prima Gas Technology’s P/S?

We usually caution against reading too much into the price-to-sales ratio when making investment decisions, even though it can say a lot about what other market participants think about the company.

The fact that Sino Prima Gas Technology is currently trading at a price-to-earnings ratio in line with the rest of the industry surprises us, given that the company’s revenues have been declining over the medium term recently, while the industry is geared towards growth. Although it is in line with the industry average, we are unhappy with the current price-to-earnings ratio, given that this dismal revenue trend is unlikely to support a more positive sentiment for long. Unless the circumstances of the recent medium-term performance improve, it would not be wrong to expect a difficult time for the company’s shareholders.

You always have to keep an eye on risks, for example: Sino Prima Gas Technology has 1 warning signal In our opinion, you should be aware of this.

Naturally, Profitable companies with a history of strong earnings growth are generally safer bets. You may want to see this free Collection of other companies that have reasonable P/E ratios and strong earnings growth.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.