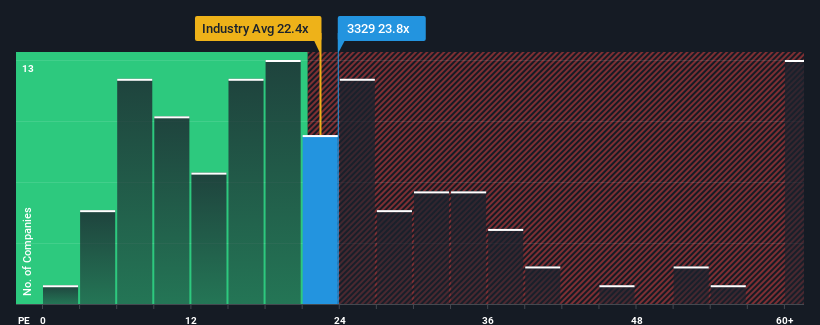

Towa Food Service Co., Ltd. (TSE:3329) price-to-earnings ratio (or “P/E”) of 23.8 might make it seem like a heavy sell compared to the Japanese market right now, where about half of the companies have P/E ratios below 12x, and even P/E ratios below 8x are quite common. However, it’s not wise to simply take the P/E ratio at face value, as there might be an explanation as to why it’s so high.

Towa Food Service has certainly done a great job of growing earnings at a very rapid pace recently. The P/E ratio is probably so high because investors believe this strong earnings growth will be enough to outperform the broader market in the near future. If not, existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Towa Food Service

Do you want a complete overview of the company’s profit, sales and cash flow? Then free The Towa Food Service report will help you shed light on the service’s past performance.

What do growth metrics tell us about the high P/E ratio?

To justify its P/E ratio, Towa Food Service would need to deliver outstanding growth that significantly outperformed the market.

First, if we look back, we can see that the company managed to grow its earnings per share by an impressive 66% last year. However, the last three-year period was not so great overall, as it produced no growth at all. Therefore, it seems to us that the company has had a mixed result in terms of earnings growth during this period.

Compared to the market, which is forecast to grow by 9.8 percent over the next twelve months, the company’s momentum is weaker based on the latest medium-term annualized earnings figures.

With this in mind, it is alarming that Towa Food Service’s P/E ratio is higher than most other companies. It seems that most investors are ignoring the fairly low recent growth rates and hoping for a turnaround in the company’s business prospects. There is a good chance that existing shareholders are setting themselves up for future disappointment if the P/E ratio falls to a level more in line with recent growth rates.

What can we learn from Towa Food Service’s P/E ratio?

It is argued that the price-to-earnings ratio is not a good measure of value in certain industries, but can be a meaningful indicator of business sentiment.

We have found that Towa Food Service is currently trading at a significantly higher P/E than expected, as recent growth over the past three years is below the overall market forecast. At the moment, we are increasingly uncomfortable with the high P/E, as this earnings trend is unlikely to sustain such positive sentiment for long. Unless recent medium-term conditions improve significantly, it is very difficult to accept these prices as reasonable.

There are many potential risks in a company’s balance sheet. You can identify many of the main risks using our free Balance sheet analysis for Towa Food Service with six simple checks.

Naturally, If you take a closer look at some good candidates, you may come across a fantastic investment. So take a look at the free List of companies with a strong growth track record and a low P/E ratio.

Valuation is complex, but we are here to simplify it.

Find out if Towa Food Service could be undervalued or overvalued with our detailed analysis, including Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.