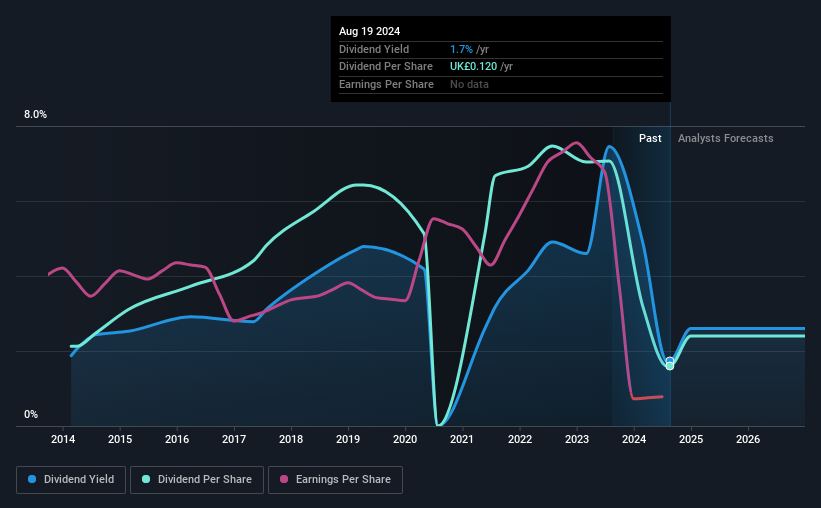

St James’s Place plc (LON:STJ) is reducing its dividend on September 20th from last year’s comparable payment to £0.06. This means the annual payment will be 1.7% of the current share price, which is lower than what the rest of the industry is paying.

While the dividend yield is important for income investors, it is also important to consider large price swings as these generally exceed any gains from distributions. Investors will be pleased to see that St. James’s Place’s share price is up 45% over the last 3 months, which is good for shareholders and may also explain a decline in the dividend yield.

Check out our latest analysis for St. James’s Place

St. James’s Place’s distributions may be difficult to sustain

Even low dividend yields can be attractive if they are predictable over a long period of time. Although St. James’s Place does not make a profit, it still pays a dividend. Moreover, it does not generate free cash flows either, which raises doubts about the sustainability of the dividend.

Earnings per share are forecast to grow 98.9% next year. While that’s the right direction, it’s not enough to become profitable. If that doesn’t happen in the short term, it could be difficult to maintain the dividend.

Dividend volatility

The company’s dividend history has been marked by instability, with at least one cut in the last 10 years. The annual payment over the last 10 years was £0.16 in 2014 and the payment in the last financial year was £0.12. This represents a decline of approximately 2.8% per year over that period. A company that cuts its dividend over time is generally not what we look for.

Dividend growth prospects are limited

Because the dividend has been cut in the past, we need to check if earnings are growing and if that could lead to higher dividends in the future. Over the last five years, St. James’s Place’s earnings per share seem to have declined by about 4.9% per year. Falling earnings will inevitably lead to the company paying a lower dividend to match lower earnings. However, things actually look better next year, with earnings set to grow. We’d just wait for this to become a pattern before getting too excited.

We are not big fans of St. James’s Place’s dividend

Overall, the dividend seems to have been a bit high, which explains why it has now been cut. The company’s earnings are not high enough to support such high payouts, nor are they backed by strong growth or consistency. We don’t think this is a good candidate for a dividend stock.

Market movements show how much a consistent dividend policy is valued compared to a more erratic one. At the same time, there are other factors that our readers should be aware of before putting capital into a stock. For example, we have selected the following: 1 warning sign for St. James’s Place investors should consider. Looking for more high yield dividend ideas? Try our Collection of strong dividend payers.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.