Last week you may have seen that Suntory Beverage & Food Limited (TSE:2587) has released its half-year results. The initial reaction was not positive, with shares falling 5.9% to JP¥4,814 last week. It looks like the results were a bit negative overall. While revenues of JP¥817 billion were in line with analyst forecasts, statutory earnings fell short, missing estimates by 6.1% to come in at JP¥84.92 per share. Following the results announcement, analysts updated their earnings model, and it would be good to know if they think the company’s outlook has changed a lot, or if it’s business as usual. Therefore, we’ve gathered the latest statutory consensus estimates following earnings announcements to see what might be in store for next year.

Check out our latest analysis for Suntory Beverage & Food

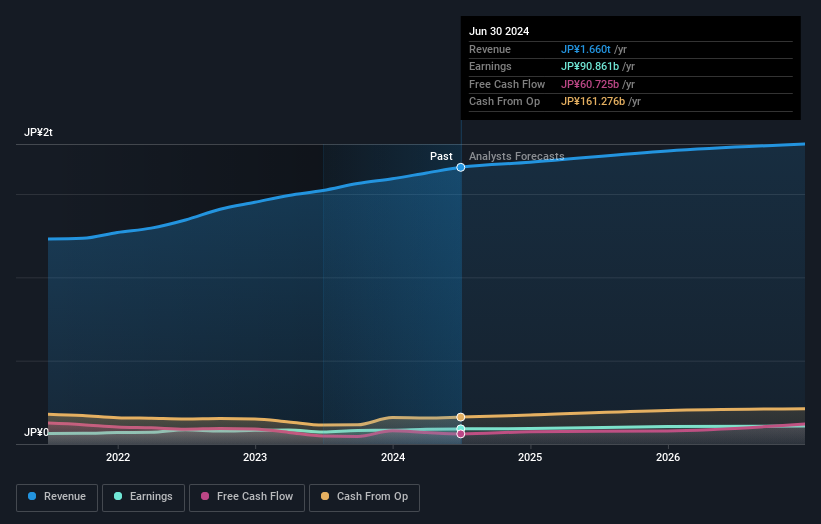

Taking into account the latest results, Suntory Beverage & Food’s seven analysts currently expect revenues of JP¥1.69 trillion in 2024, roughly in line with the last 12 months. Earnings per share are expected to increase 2.3% to JP¥301. Prior to this earnings report, analysts had been forecasting revenues of JP¥1.70 trillion and earnings per share (EPS) of JP¥303 in 2024. The consensus analysts don’t seem to have seen anything in these results that would have changed their view on the business, as there have been no material changes to their estimates.

It will therefore come as no surprise that the consensus price target remains largely unchanged at JP¥6,283. However, fixating on a single price target may be unwise as the consensus target is actually the average of analysts’ price targets. Therefore, some investors like to look at the range of estimates to see if there are any differing opinions on the company’s valuation. The most optimistic Suntory Beverage & Food analyst has a price target of JP¥7,700 per share, while the most pessimistic puts it at JP¥5,100. This shows that there is still some divergence in estimates, but analysts do not seem to be completely divided on the stock as if it could be a make or break situation.

We can also look at these estimates in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether the forecasts are more or less optimistic compared to other companies in the industry. We’d like to highlight that Suntory Beverage & Food’s revenue growth is expected to slow down. The forecast annualized growth rate of 3.7% through the end of 2024 is well below the historical growth of 6.1% per year over the past five years. For comparison, the other companies in this industry covered by analysts are forecast to grow their revenues by 2.1% per year. So, it’s pretty clear that while Suntory Beverage & Food’s revenue growth is expected to slow down, it will still grow faster than the industry itself.

The conclusion

Most importantly, there were no major changes in sentiment. Analysts confirmed that the company is performing in line with their previous earnings per share estimates. Fortunately, there were no major changes in revenue estimates, and the company is still expected to grow faster than the wider industry. There were no real changes in the consensus price target, suggesting that the company’s intrinsic value has not changed much with the latest estimates.

However, the long-term trajectory of company earnings is much more important than the next year. At Simply Wall St, we have a full range of analyst estimates for Suntory Beverage & Food out to 2026, and you can see them free on our platform here.

Another point to consider is whether management and directors have bought or sold shares recently. Here on our platform you will find an overview of all open market share trades over the last twelve months.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.