Even if a company is losing money, shareholders can make money if they buy a good company at the right price. Biotechnology and mining companies, for example, often lose money for years before they succeed with a new treatment or mineral discovery. However, unprofitable companies are risky because they could potentially burn through all their cash and get into trouble.

The natural question for Novacyt (EPA:ALNOV) Shareholders are wondering if they should be concerned about the cash burn percentage. In this article, we define cash burn as annual (negative) free cash flow, which is the amount a company spends each year to fund its growth. The first step is to compare cash burn to cash reserves to determine its cash runway.

Check out our latest analysis for Novacyt

How long is Novacyt’s cash runway?

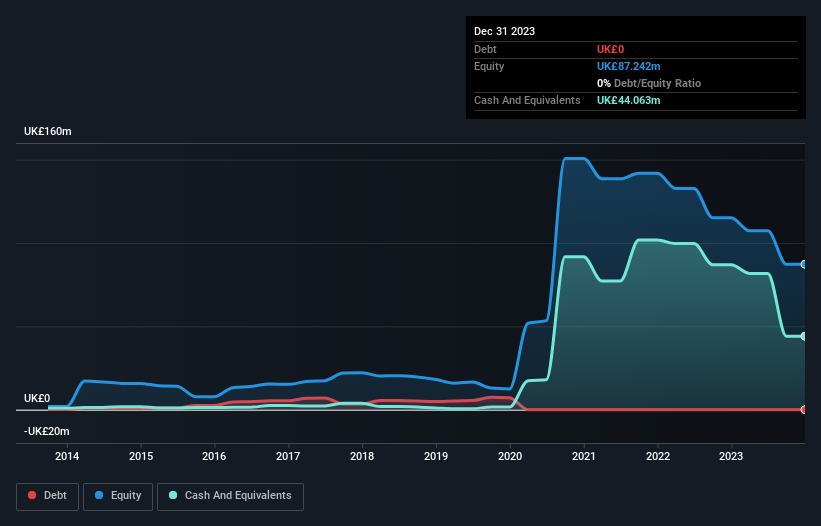

A cash runway is defined as the amount of time it would take a company to run out of cash if it continued to spend at its current cash burn rate. When Novacyt reported its last balance sheet in February 2024, for December 2023, it had no debt and cash worth £44m. Over the last year, the company burned through £26m, so as of December 2023 it had a cash runway of around 21 months. While this cash runway is not too worrying, sensible holders would look further ahead and consider what happens if the company runs out of cash. The image below shows how cash levels have changed over the past few years.

How well is Novacyt growing?

Novacyt actually increased its cash burn by a whopping 81% over the last year, which shows that it is increasing its investment in the business. As if that wasn’t bad enough, operating income also fell by 45%, which makes us very suspicious. Given the above, we are quite suspicious of the trajectory the company appears to be on. Of course, we’ve only taken a quick look at the stock’s growth metrics here. You can see how Novacyt has grown its business over time by looking at this visualization of its revenue and earnings history.

Can Novacyt easily raise more money?

Novacyt’s revenue is falling and its cash burn is rising, so many are considering raising more cash in the future. Generally speaking, a publicly traded company can raise new cash by issuing stock or taking on debt. Many companies ultimately issue new stock to fund future growth. By looking at a company’s cash burn relative to its market capitalization, we gain insight into how diluted shareholders would be if the company had to raise enough cash to cover another year’s worth of cash burn.

Given that Novacyt’s market capitalization is £36 million, Novacyt’s cash burn of £26 million represents approximately 71% of its market value. Given the magnitude of this cash burn relative to the market value of the entire company, we would classify the stock as high risk, with a risk of extreme dilution.

Is Novacyt’s cash burn a concern?

After this analysis of Novacyt’s cash burn, we find the cash runway to be reassuring, while the cash burn relative to market capitalization worries us a little. Taking into account all the measures mentioned in this report, we believe the cash burn is quite risky and if we were holding shares, we would watch like a hawk for any deterioration. In addition, Novacyt has 3 warning signs (and 2 that are concerning) that we think you should know about.

Naturally, If you look elsewhere, you may find a fantastic investment. So take a look at the free List of companies with significant insider holdings and this list of growth stocks (according to analyst forecasts)

Valuation is complex, but we are here to simplify it.

Find out if Novacyt could be undervalued or overvalued with our detailed analysis, Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.