Singapore is considered an exceptionally expensive city, especially when it comes to car and property prices. Below, we compare the cost of renting and buying HDBs in different areas of the island to help renters and home buyers get an idea of property prices across Singapore. In addition, we analyze trends in the rental and resale markets and discuss what they mean for consumers.

The hottest rental areas in Singapore

Central, Bukit Merah and Queenstown were the most expensive rental markets in 2017. Followed by Kallang/Whampoa and Clementi, these areas are all in close proximity to the National University of Singapore (NUS) and the city centre. The rental price for an average 4-room HDB flat in all these areas was at least S$200 higher than the national average.

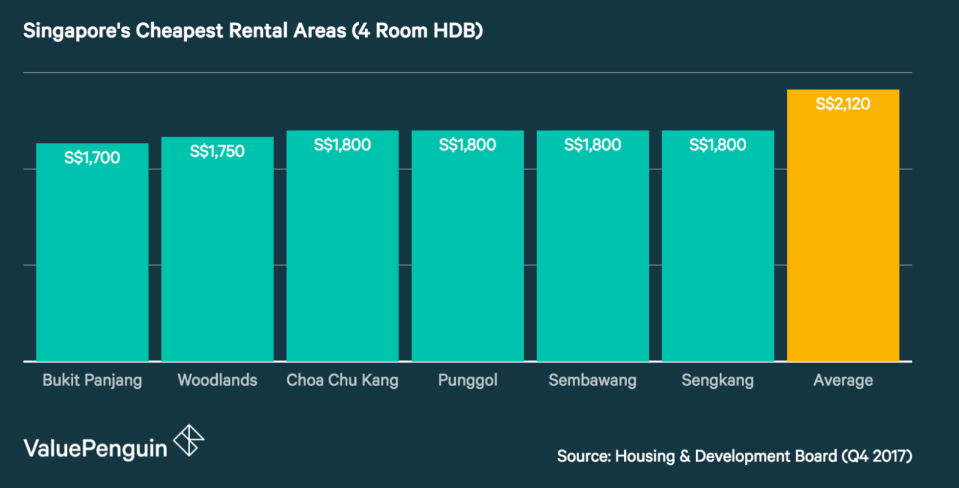

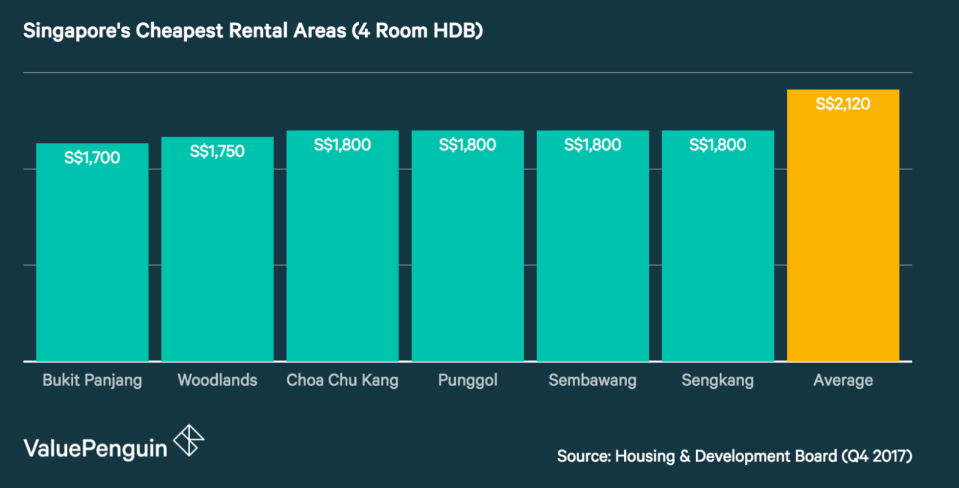

The cheapest rental areas in Singapore

Bukit Panjang remains the cheapest area in Singapore for renters, followed by Woodlands, Choa Chu Kang, Punggol, Sembawang and Sengkang. The median rental price for a 4-room HDB in all 6 of these areas is more than S$300 cheaper than the national average.

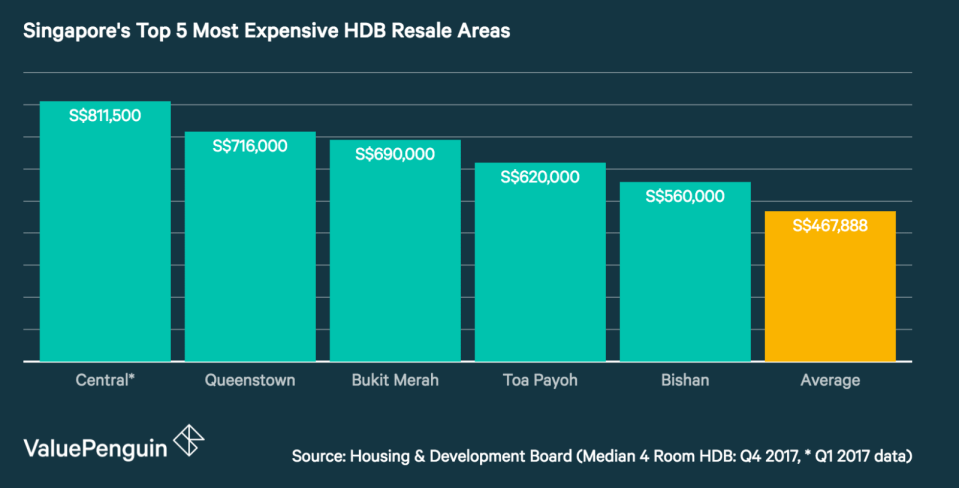

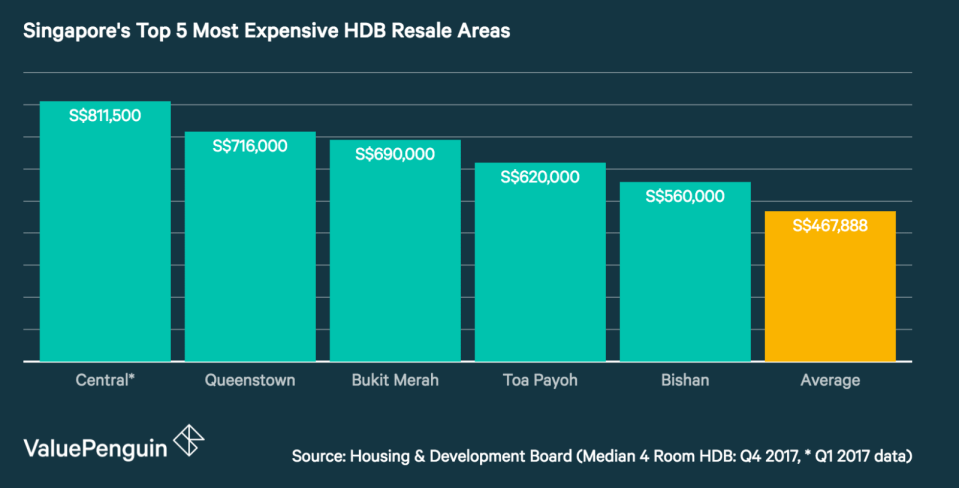

The most expensive HDB resale areas in Singapore

The Central Area, Queenstown and Bukit remain the most expensive areas in Singapore. From 2015 to 2017, prices in Toa Payoh increased by 17%, making it the fourth most expensive town in Singapore. Bishan rounds out the top 5 with a median resale price of S$560,000. The median resale price of a 4-room HDB in all 5 of these areas exceeded the national average by at least S$90,000.

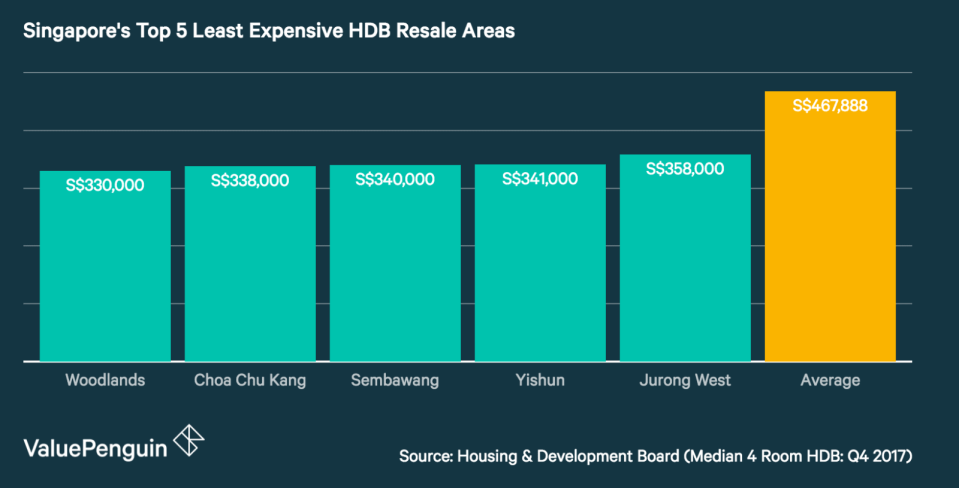

The cheapest HDB resale areas in Singapore

Woodlands was the cheapest area in Singapore at the end of 2017. The average price for a 4-room HDB was S$330,000. Woodlands was followed by Choa Chu Kang, Sembawang, Yishun and Jurong West. Average prices in all five areas were at least S$100,000 lower than the national average.

A blessing for tenants: recent decline in rents

Much to the delight of renters in Singapore, the average median rent for 4-room HDBs fell by 3.67% to S$2,120 in 2017 and by 13.16% over the past 3 years. Rents fell the most in areas further from the city centre, with Jurong West, Punggol and Sengkang seeing the largest rental price declines of around 20%. Areas closer to the city centre saw less of a decline, with rents in Geylang falling by 5% and rents in Kallang/Whampoa falling by 7%.

The decline appears to be due to both government intervention and market dynamics. For example, the government has taken measures to cool down the housing market in recent years. At the same time, the supply of HDB flats has increased. From 2013 to 2016, the number of HDB and DBSS units increased by 8% to 1,142,015, outpacing the population growth of 4% during those years. It seems that these two factors have led to cheaper rents in Singapore.

Tenants looking to relocate may be able to benefit from falling rents. For example, neighbourhoods such as Jurong East have seen a significant drop (-16%) in rents since 2014 and are still relatively close to NUS and the city centre. Living in this neighbourhood would provide prospective tenants with a convenient location while saving money compared to more expensive areas.

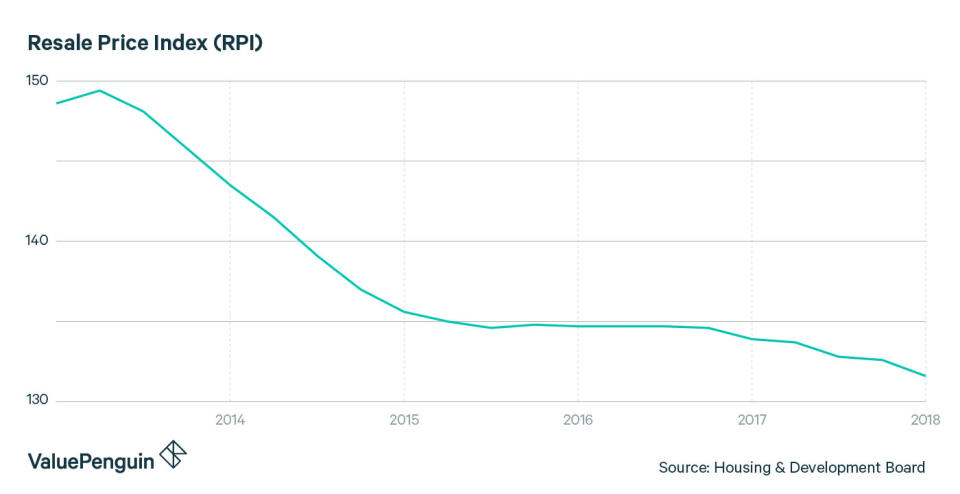

Buyer beware: Falling resale prices

While renters can rejoice in falling rental prices, property owners and property investors should be cautious when purchasing a property due to recent trends in the HDB resale market. HDB prices have followed a similar trend to the rental market. The Resale Price Index (RPI), which measures price changes in the HDB flat market, has declined continuously from late 2013 (145.8) to 2017 (132.6). Areas such as Bedok and Woodlands are examples of this decline and recorded the sharpest declines, with resale prices falling by 27% and 25% respectively from 2014 to 2017. However, there are exceptions. For example, prices in Toa Payoh rose by 17% between 2015 and 2017.

The HDB resale market is affected by many of the same factors as the rental market. For example, both government policies and an increase in HDB supply have likely influenced resale prices. Falling rents also have a direct negative impact on property values. This is because landlords receive less rental income or returns from their investment properties.

While individuals looking for a good deal may see this drop in prices as a good time to buy an HDB, there is also reason to be cautious. First, falling property values and rental income are particularly bad when interest rates are rising at the same time. Recently, SIBOR rates have been gradually increasing along with US rates, making home loans more expensive. In addition, there is some uncertainty about the future of HDB leases, which are about to expire. These factors should not completely deter prospective home buyers, but they are important and should be considered when making a major financial decision such as buying a property.

The article “The cheapest and most expensive areas to live in Singapore” originally appeared on ValuePenguin.

ValuePenguin helps you find the most relevant information to optimize your personal finances. Like us on our Facebook page to stay up to date with our latest news and articles.

More from ValuePenguin: