Anyone interested in Kinaxis Inc. (TSE:KXS) should probably be aware that Chief Sales Officer, Claire Rychlewski, recently disposed of CA$668,000 worth of the company’s stock at an average price of CA$152 per share. Equally important, this sale actually reduced her stake by a whopping 69%, which hardly makes us optimistic about the stock.

Check out our latest analysis for Kinaxis

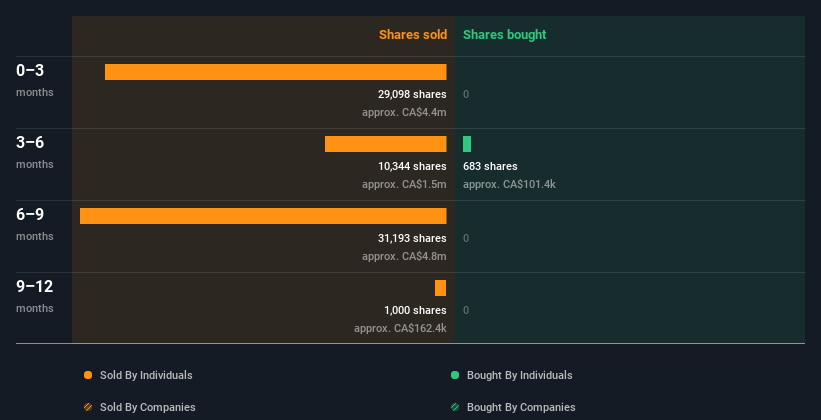

Kinaxis insider transactions in the last year

CEO, President and Director John Sicard made the largest insider sale of the last 12 months. This single transaction involved CA$4.4 million worth of shares at a price of CA$152 a share. So it’s clear that an insider wanted to take some money off the table, even below the current price of CA$155. Generally, we consider it discouraging when insiders sell below the current price because it gives the impression that they were happy with a lower valuation. While insider sales are sometimes discouraging, they are only a weak signal. It’s worth noting that this sale only involved 9.4% of John Sicard’s shares.

Overall, insiders have sold more Kinaxis shares than they have bought in the last year. The chart below shows insider transactions (by companies and individuals) over the last year. If you click on the chart, you can see all the individual transactions, including share price, individual, and date!

For those who like to find hidden gems The free A list of small-cap companies with recent insider buying might be just the thing.

Insider ownership

For a common shareholder, it’s worth checking how many shares are held by company insiders. Typically, the higher the insider ownership, the more likely it is that insiders are motivated to build the company for the long term. Insiders own 1.3% of Kinaxis shares, worth about CA$55 million. We’ve certainly seen higher insider ownership elsewhere, but these percentages are enough to indicate alignment between insiders and the other shareholders.

So what do Kinaxis’ insider transactions mean?

Insiders have recently sold shares, but they haven’t bought. Despite some insider buying, the long-term picture doesn’t make us much more optimistic. On the positive side, Kinaxis is making money and growing its earnings. Insider ownership isn’t particularly high, so this analysis makes us cautious about the company. We would exercise some caution before buying! So these insider transactions can help us build a thesis about the stock, but it’s also worth knowing the risks this company faces. To support this, we found out: 1 warning sign which you should take a look at to get a better idea of Kinaxis.

Naturally, If you look elsewhere, you may find a fantastic investment. So take a look at the free List of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulator. Currently, we only consider open market transactions and private disposals of direct holdings, but not derivative transactions or indirect holdings.

Valuation is complex, but we are here to simplify it.

Find out if Kinaxis could be undervalued or overvalued with our detailed analysis, with Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.