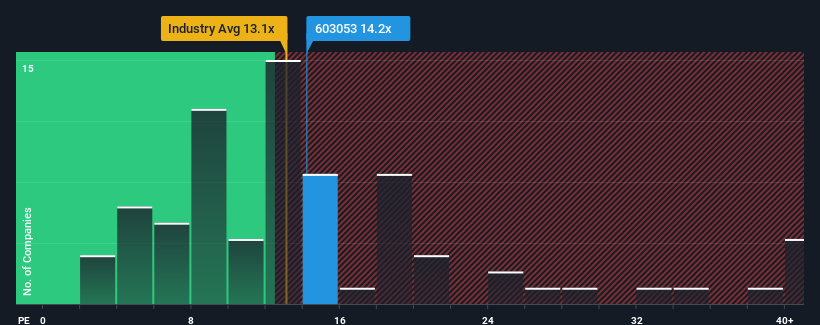

If almost half of the companies in China have a price-earnings ratio (P/E) of over 27, you can consider Chengdu Gas Group Corporation Ltd. (SHSE:603053) with its P/E ratio of 14.2x appears to be an attractive investment. However, we would have to dig a little deeper to determine if there is a rational basis for the reduced P/E ratio.

Chengdu Gas Group’s earnings have been growing significantly recently, which is encouraging. One possibility is that the P/E ratio is low because investors believe this respectable earnings growth may actually lag the overall market in the near future. If you like the company, you’d hope that doesn’t happen so you can potentially buy some shares while it’s out of demand.

Check out our latest analysis for Chengdu Gas Group

Do you want a complete overview of the company’s profit, sales and cash flow? Then free The report on Chengdu Gas Group will help you shed light on its historical performance.

What do growth metrics tell us about the low P/E ratio?

A P/E ratio as low as that of Chengdu Gas Group would only be really comfortable if the company’s growth lagged behind the market growth.

First, if we look back, we can see that the company has grown earnings per share by a remarkable 11% over the past year. The solid recent performance means that it has also achieved a 15% increase in earnings per share over the past three years in total. So it’s fair to say that the recent earnings growth for the company has been impressive.

Compared to the market, which is forecast to grow by 36 percent over the next twelve months, the company’s momentum is weaker based on recent medium-term annualized earnings figures.

With this information, we can see why Chengdu Gas Group is trading at a lower P/E than the market. It seems that most investors expect the recent low growth rates to continue into the future and are only willing to pay a lower amount for the stock.

The most important things to take away

We usually caution against reading too much into the price-earnings ratio when making investment decisions, even though it can say a lot about what other market participants think about the company.

As we suspected, our research into Chengdu Gas Group found that the three-year earnings trends contribute to its low P/E as they look worse than current market expectations. Currently, shareholders accept the low P/E as they acknowledge that future earnings are unlikely to bring pleasant surprises. Unless recent medium-term conditions improve, they will continue to form a barrier to the share price around these levels.

Before you take the next step, you should know about the 1 warning signal for the Chengdu Gas Group that we uncovered.

Naturally, If you take a closer look at some good candidates, you may come across a fantastic investment. So take a look at the free List of companies with a strong growth track record and a low P/E ratio.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own metric from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.