The Zacks Oil and Gas industry – Exploration and Production – U.S. is facing several bearish trends that could put pressure on overall performance. A sluggish economic outlook coupled with China’s slowing growth has prompted the EIA to revise downward its forecast for global crude oil consumption for 2025. In addition, the accelerated shift to renewable energy and electric vehicles (EVs) is likely to further dampen traditional oil demand. Despite these challenges, U.S. upstream operators are adapting by prioritizing shareholder returns. Companies are taking advantage of strong free cash flow and reducing capital spending by putting excess cash into dividends and buybacks. Among these Devon Energy DVN, SM Energy sms, Northern Oil and Gas NOG and Increase energy AMPY stands out as a robust investment that is well positioned to weather the current headwinds while providing investors with attractive returns.

About the industry

The Zacks Oil and Gas – US E&P industry consists of companies primarily based in the domestic market and focused on the exploration and production (E&P) of oil and natural gas. These firms find hydrocarbon deposits, drill oil and gas wells, and produce and sell these materials to later process them into products such as gasoline, heating oil, distillate, etc. The economics of supply and demand in oil and gas are the fundamental drivers of this industry. Notably, a producer’s cash flow is primarily determined by the commodity prices realized. In fact, the results of all E&P companies are vulnerable to historically volatile prices in the energy markets. A change in realizations impacts their earnings and causes them to change their production growth rates. E&P operators are also exposed to exploration risks where drilling results are comparatively uncertain.

3 key trends to watch in the US oil and gas industry

Declining demand and economic concerns: Due to several factors, US oil prices are struggling to break above $80 per barrel. The EIA’s revised forecast for global crude oil consumption to reach 104.5 million barrels per day in 2025, 200,000 barrels less than previous estimates, reflects concerns about a potential recession in the US and a slowing Chinese economy. With a reduced demand growth rate of 1.6%, these factors are putting downward pressure on oil prices and highlighting vulnerabilities in global oil demand caused by economic uncertainties in major markets.

Energy transition and introduction of electric vehicles: The push toward renewable energy and the rise of electric vehicles pose significant long-term risks to traditional oil and gas demand. Despite currently slow infrastructure development, advances in renewable energy and increasing adoption of electric vehicles could reduce dependence on fossil fuels and drive oil prices lower. However, China’s rapid electrification is causing the country’s oil demand to peak and decline sooner than expected. The country’s oil imports, which totaled 11.4 million barrels per day in 2023, are expected to stagnate through 2026 and decline thereafter. This shift accelerates a global oversupply trend and contributes to lower oil prices as demand wanes.

Prioritizing shareholder returns: Despite the turmoil in the energy market, upstream operators offer a low-cost way to gain broad exposure to leading blue-chip energy stocks that have strong free cash flow and attractive dividend growth. Cash flow from operations in particular is on a sustainable path as revenues stabilize and companies dramatically reduce capital spending from pre-pandemic levels as commodity prices remain at healthy levels for market participants. Simply put, efficiency improvements in recent years have helped E&P companies generate significant “excess liquidity” that they hope to use to boost returns for investors. In fact, more and more energy companies are distributing their growing cash piles in the form of dividends and buybacks to appease long-suffering shareholders.

Zacks Industry Rank indicates a pessimistic outlook

The Zacks industry Oil and Gas – US E&P is a 35-stock group within the broader Zacks Oil – Energy sector. The industry currently has a Zacks Industry Rank of 174, which puts it in the bottom 30% of the 250 Zacks industries.

The group’s Zacks Industry Rank, which is essentially the average of the Zacks Rank of all member stocks, suggests a challenging near-term outlook. Our research shows that the top 50% of Zacks-ranked industries outperform the bottom 50% by more than two times.

The industry’s position in the bottom 50% of the Zacks-ranked industries is a result of negative earnings outlook for the companies as a whole. Looking at the revisions to overall earnings estimates, it appears that analysts are becoming more pessimistic about the earnings growth potential of this group. While the industry’s earnings estimates for this year have declined 26.4% over the past year, they have declined 10.8% for 2025 over the same period.

Despite the industry’s bleak short-term outlook, we’ve outlined some stocks to consider for your portfolio. But it’s worth taking a look at shareholder returns and the industry’s current valuation first.

Industry performs worse than S&P 500 and sector

The Zacks Oil and Gas U.S. E&P industry has underperformed the Zacks S&P 500 Composite as well as the broader Zacks Oil-Energy sector over the past year.

The industry recorded a loss of 3.8 percent during this period, while the sector as a whole recorded only a modest increase of 1.1 percent. The S&P 500, meanwhile, rose by 19.1 percent.

Price development over one year

Current assessment of the industry

Since oil and gas companies are highly leveraged, it makes sense to value them using the EV/EBITDA (enterprise value/earnings before interest, taxes, depreciation and amortization) ratio. This is because this valuation metric takes into account not only equity but also the amount of debt. For capital-intensive companies, EV/EBITDA is a better valuation metric because it is not affected by changing capital structures and ignores the impact of non-cash expenses.

Based on the trailing 12-month enterprise value to EBITDA (EV/EBITDA) ratio, the industry is currently trading at 7.39X, which is well below the S&P 500’s 17.92X. However, it is above the sector’s trailing 12-month EV/EBITDA ratio of 3.13X.

Over the past five years, the industry has traded at highs of 11.82X, lows of 3.52X, and a median of 5.98X.

Ratio of enterprise value to EBITDA (EV/EBITDA) for the last 12 months (last five years)

4 Stocks to Buy

SM Energy Company: Based in Denver, Colorado, SM Energy Company, formerly known as St. Mary Land & Exploration Company, is an independent oil and gas exploration company in North America. The company’s activities are focused on the Permian Basin, South Texas and Gulf Coast regions.

The Zacks Consensus Estimate for SM for 2024 indicates year-over-year earnings per share growth of 27.7%. The Zacks Rank #1 (Strong Buy) company has surprised with an average earnings of around 11.9% over the past four quarters. SM Energy shares have gained 13.5% in a year. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Price and consensus: SM

Devon Energy: It is an upstream energy exploration company with strong U.S. operations spanning key oil plays in the Delaware Basin, Eagle Ford, Anadarko Basin, Williston Basin and Powder River Basin. By improving cycle times, incorporating production optimization strategies and other cost reduction initiatives, DVN can reduce break-even costs across its portfolio of assets.

Devon Energy’s expected three-to-five-year EPS growth rate is currently 11.1%, which compares favorably to the industry’s growth rate of 9.4%. The Zacks Consensus Estimate for DVN’s earnings in 2024 has moved 4.8% higher over the past 60 days. Shares of the Zacks Rank #2 (Buy) company have lost 11.2% in one year.

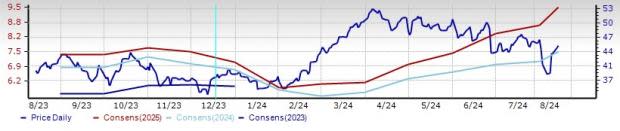

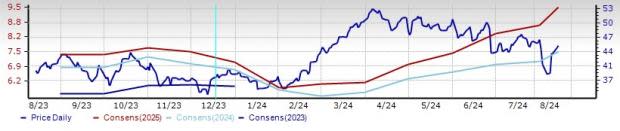

Price and consensus: DVN

Northern Oil and Gas: Northern Oil and Gas’s core operations are focused on three key U.S. basins – the Williston, Permian and Appalachian Basins. The upstream operator pursues a unique non-operating business model that helps it keep costs low and increase free cash flow.

The Zacks Consensus Estimate for NOG’s 2024 earnings, which carries a Zacks Rank of 2, has moved 3% higher over the past 60 days. Northern Oil and Gas has delivered an average earnings surprise of around 7.4% over the past four quarters. The company’s shares have fallen 5.6% over the past year.

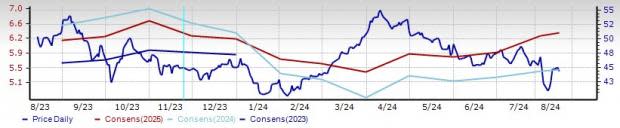

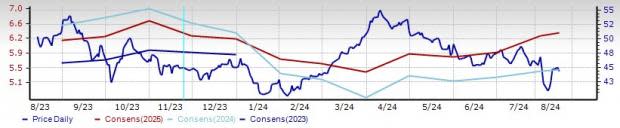

Price and consensus: NOG

Increase energy: The Houston, Texas-based operator has a strong presence in Oklahoma, Southern California and Texas, and owns interests such as Bairoil in the Rocky Mountains. Amplify Energy’s diversified operations – spread across five U.S. basins – mitigate price and operational disruptions, while its long-lived, high-production assets generate sustainable cash flows.

The Zacks Consensus Estimate for Amplify Energy’s earnings in 2024 has moved 11.3% higher over the past 60 days. With a Zacks Rank of 2, the oil and natural gas producer has a market capitalization of $281.8 million. AMPY shares have fallen 1.4% in a year.

Price and Consensus: AMPY

Want the latest recommendations from Zacks Investment Research? Download the 7 best stocks for the next 30 days today. Click here to get this free report

Devon Energy Corporation (DVN): Free Stock Analysis Report

Northern Oil and Gas, Inc. (NOG): Free Stock Analysis Report

Amplify Energy Corp. (AMPY): Free Stock Analysis Report

SM Energy Company (SM): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research